What is Payday Loan Equity Alliance and how can it help you?

Lyle Solomon

Lyle Solomon is the principal attorney and the Payday Loan Equity Alliance Director at Oak View Law Group.

Virendra Kalani

Virendra Kalani is the founder, principal attorney, and one of the directors at OVLG Payday Loan Equity Alliance.

What is payday loan equity alliance and how can it help you?

Payday lenders usually have an advantage over borrowers. The Payday Loan Equity Alliance's goal is to lobby the government for better payday loan laws and give financial education to borrowers. The annual membership fee for the Payday Lending Equity Alliance is currently $1200 (subject to change based on the organization's policies). Members are encouraged to publish the latest state payday loan laws on OVLG at least once a year and stay updated with the evolving lending landscape.

Table of Contents

- WHAT IS PAYDAY LOAN EQUITY ALLIANCE AND HOW CAN IT HELP YOU?

- WHAT IS A PAYDAY LOAN?

- EMOTIONAL AND PSYCHOLOGICAL IMPACT OF PAYDAY LOANS

- WHY ARE PAYDAY LOANS CONSIDERED PREDATORY?

- SCARY PAYDAY LOAN FACTS

- STATE PAYDAY LOAN LAWS

- HOW CAN PAYDAY LOAN COMPANIES TRAP YOU?

- NAVIGATING OUT OF PAYDAY LOAN DEBT

- VICTIMS OF PAYDAY LOAN SCAMS

Payday Loan Equity Alliance members can help you:

- Payday Loan Equity Alliance members can help you:

- Know about the recent payday loan laws and understand your rights.

- Distinguish between legal and illegal payday loan companies.

- Deal with illegal lenders tactfully.

- Settle payday loans and save money.

- Spot and avoid payday loan scams.

What is a payday loan?

Payday loans are short-term loans you must repay with your next paycheck. These loans have certain features:

- They can be high-cost loans, with APRs potentially varying based on current market conditions.

- Available both through storefront and online lenders.

- The loan amount and terms might change based on economic conditions and individual lender policies.

- Repayment methods include post-dated checks or electronic debits, but always ensure you know the terms to avoid unexpected debits.

- They are often marketed as bad credit loans, but always ensure you understand the terms and implications.

Emotional and psychological impact of payday loans

Being trapped in payday loan debt can be emotionally draining. The constant worry about repayment and aggressive lending practices can lead to stress, anxiety, and other mental health issues. It's essential to seek support and guidance if you feel overwhelmed.

Back To IndexWhy are payday loans considered predatory?

Payday loans have a reputation for being predatory due to several reasons, some of which include:

- Not considering the borrower's ability to repay.

- High APRs compared to other financial products.

- Presence of scams and unlicensed lenders.

- Aggressive collection practices, including unauthorized debits leading to overdraft fees.

Scary payday loan facts

Various statistics highlight the challenges with payday loans. Always cross-reference these numbers with up-to-date sources to ensure accuracy.

Here are some scary payday loan facts for 2023:

- Payday loans can have annual interest rates of 300% to 500%. This means that if you borrow $100 for two weeks, you could end up paying back $150 or more.

- Payday loans are often predatory and target people who are struggling financially. Lenders may use deceptive practices to lure borrowers into taking out loans, making it difficult for borrowers to repay their loans.

- Payday loan borrowers are more likely to default on their loans than borrowers of other types of loans. This can lead to a cycle of debt and financial hardship.

- Payday loans can have a negative impact on borrowers' credit scores. This can make it difficult for borrowers to qualify for other types of loans in the future.

- Payday loan borrowers are more likely to experience financial hardship, such as bankruptcy and foreclosure. This is because payday loans can trap borrowers in a cycle of debt.

The following are the top 5 states with the highest APRs in 2023:

- Mississippi (31.9%)

- Louisiana (31.8%)

- Alabama (31.6%)

- Arkansas (31.5%)

- South Carolina (31.4%)

The following are the top 5 states with the highest number of payday lenders in 2023:

- Mississippi (1,100)

- Texas (1,652)

- California (2,451)

- Tennessee (1,344)

- Alabama (850)

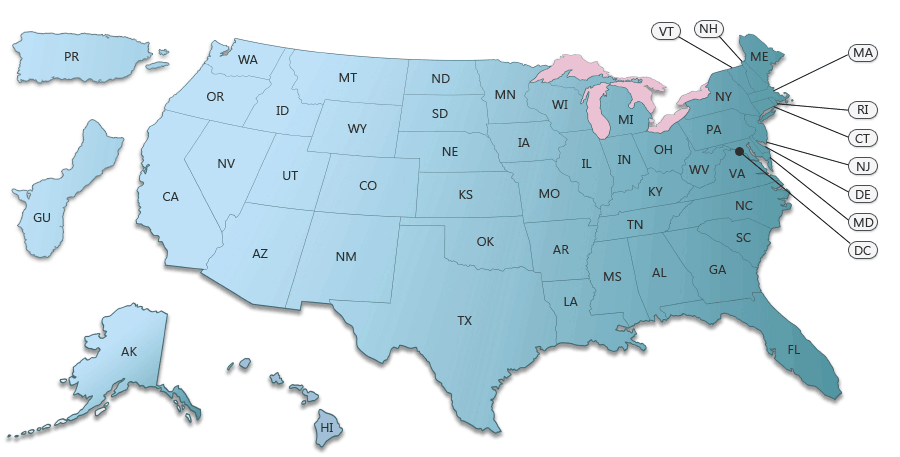

State payday loan laws

It's crucial to be aware of your state's payday loan laws. These laws can provide information on the legality, maximum loan amounts, and APRs allowed in your state. Always consult the latest regulations or legal resources for accurate information.

US Payday Loan laws - Check if payday loans are legal in your state

How can payday loan companies trap you?

Payday loan companies employ various tactics to ensure borrowers remain in debt. Be wary of:

- Exorbitant interest rates that might not align with state laws.

- False threats or claims from unlicensed or tribal lenders.

- Unauthorized debits lead to overdraft fees.

Navigating out of payday loan debt

If trapped in payday loan debt:

- Seek guidance from organizations like the Payday Loan Equity Alliance.

- Understand your rights and the laws related to payday loans.

- Consider changing bank accounts to prevent unauthorized debits.

- Explore debt relief options, including consolidation and settlement.

Additional tips:

- Make a budget. This will help you track your income and expenses to see where your money is going.

- Reduce your expenses. This may mean cutting back on unnecessary expenses like eating out or going to the movies.

- Increase your income. This may mean getting a part-time job or starting a side hustle.

- Get a personal loan from a bank or credit union. This may have a lower interest rate than a payday loan.

- Get help from a credit counseling agency. They can help you create a budget and develop a plan to pay off your debt.

- Do not take out another payday loan. This will only make your situation worse.

Victims of payday loan scams

If you believe you've been scammed:

- Report to agencies like the FTC, or your State Attorney General.

- Inform friends, family, and employers to be on the lookout for suspicious activities.

- Stay updated on the latest scam tactics to protect yourself in the future.

Additionally, if you are a victim of a payday loan scam, there are a few things you can do:

- Gather your documentation. This includes any paperwork related to the loan, such as the loan agreement, emails or text messages you received from the lender, and bank statements showing the loan payments.

- Contact the lender. If you have not already done so, contact the lender and inform them that you believe you have been scammed. Ask them to stop all further collection activity and to return any money you have already paid.

- File a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that enforces consumer financial protection laws. You can file a complaint online at their website or by calling 1-877-CFPB-HELP (1-877-237-2435).

- File a police report. This is especially important if you have been threatened or harassed by the lender. You can file a police report online or in person at your local police station.

- Place a fraud alert on your credit report. This will make it more difficult for the scammers to open new accounts in your name. You can place a fraud alert by contacting each of the three major credit bureaus: Equifax, Experian, and TransUnion.

- Monitor your credit report for unauthorized activity. You should check your credit report regularly for any unauthorized activity, such as new accounts or inquiries. You can get a free credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com.

Updated on: May 25, 2022