California payday loans - Stay away if you love your money

- Is payday loans legal in California?

- California payday loan laws

- What can payday loan lenders do or cannot do?

- Why should you be beware of California payday loans online?

- Why is it best to avoid illegal payday loan lenders?

- How can you avoid payday loans in California?

- How can you get out of payday loan law?

- How can you get out of payday loan debt in California?

- Payday loans in California - FAQ

Payday loans in California are best when you need a short-term loan immediately but are confident about paying it off along with the high interest rate. Payday loans are also popular in this state by the following names:

- Cash advances

- Deferred deposits

- Fast cash

Is payday loans legal in California?

Both storefront and online pdls are legal in California as long as they’re licensed in the state. They need to be approved by Department of Business Oversight in California to be considered as legal.

California payday loan laws

Status: Legal (Cal. Fin. Code §§ 23000 to 23106)

Lending specifications:

- Maximum loan amount: $300

- Loan tenure: 31 days

- Fees and finance charges: 15% of the face amount of the check

- Finance charge on a 14-day $100 loan: $17.65

- APR on 14-day $100 loan: 459%

Collection restrictions:

- Collection fees: $15 NSF fee

- Criminal procedures: Prohibited

Debt limits:

- Maximum no. of outstanding loans at a time: Single

- Rollovers allowed: None (cannot charge fee for extension)

- Cooling-off phase: NA

- Repayment plan: Voluntary (no fees may be charged in connection to the repayment plan)

Complaint cell:

- Regulator: California Department of Corporations

- Address: Consumer Services Office, 1515 K Street, Suite 200 Sacramento CA 95814-4052

- Phone: (866) 275-2677 or 866 ASK CORP

- Website: https://www.dbo.ca.gov/About_DBO/organization/doc.asp

What can payday loan lenders do or cannot do?

- Give you only one loan

- Charge up to $15 for 1 bounced check fee

- Give you a contract typed in a language you understand

- Display license & fee structure at each location

- Threaten you for non payments

- Issue you a new loan to repay current loan

- Charge extra fees for an extension of repayment plan

- Issue another loan when current one is unpaid

Why should you be beware of California payday loans online?

Do you know that California Department of Business Oversight warns consumers against online payday loans? Curious to know why? Find out on your own:

- It’s difficult to determine if the lender is licensed

- The lender may be doing business offshore

- It’s hard to retrieve lost funds from offshore lender

Why is it best to avoid illegal payday loan lenders?

Why do so many experts suggest to avoid California check cashing payday loans? It’s because there are 4 reasons behind them and these are:

- Illegal lenders may withdraw money from your bank account without seeking permission

- They may charge super-high interest rate

- They may leak your personal information

- It can be very hard to track them

How to avoid pdls in CA

- 1 Set up a budget after evaluating your income and expenses

- 2 Create a rainy fund by saving 10% of your paycheck every month

- 3 Get help from credit counseling agency to create a budget

- 4 Trim unnecessary expenses and prioritize debts

- 5 Cut down necessary expenses and pay current debts

- 6 Have proper insurance plans to tackle medical emergencies

How can you get out of payday loan law?

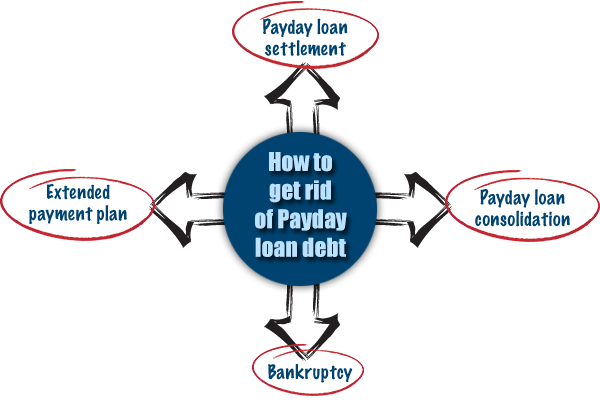

How can you get out of payday loan debt in California?

Payday loans are expensive in California. Even the best payday loans charge a very high-interest rate. So, it’s better to avoid them by all possible means. But what if you’re already in payday loan debt in California? How can you get

out of it?

Well, in such a scenario, you can take advantage of payday loan consolidation in California to lower your monthly payments. It is a professional debt

relief program that helps you to lower the huge interest rate on your payday loans. The debt consolidation company negotiates with the lenders and try their best to pull down the interest rate. They give you an affordable repayment plan

without any additional fees.

Payday loans in California - FAQ

Can you get payday loans in Sacramento California?

There are various lenders who promote California budget payday loans in Sacramento. These are nothing but false promises just to lure you. Yes, you can definitely get fast cash but be prepared to pay a high interest rate.

What can you do when lenders violate the pdl laws?

You can get in touch with the Department of Business Oversight at www.dbo.ca.gov

You can also call at their toll free number - 1-866-275-2677

You can report the matter to California State Attorney General

What if you really have to take out a pdl?

In that case, you need to take the following steps:

- Borrow an amount you can pay off

- Don’t take out another loan from a new lender

- Pay off the loan on the due date

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult a qualified attorney for advice on your specific situation.

Updated on: