Why should you be debt free and how to do it?

If you can't control your emotions, you can forget about leading a debt free life.

Staying debt free is an art. The one who learns this art fast can lead a happy financial life and the one who doesn't is doomed to lifelong miseries.

How to become debt free through OVLG

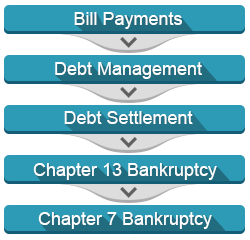

OVLG helps you in becoming a debt free man through its much talked about Waterfall approach to debt free™ life. This approach is very unique as it helps you select the right solution on the basis of your financial and debt situation.

How it works

Like it has been said, Waterfall approach to debt free™ life gives you the best solution as per your financial health and debt situation.

Find out how it works and helps you choose the right debt free option.

Financial health

- Not bad - Few unpaid bills

- Struggling - Unable to pay monthly bills

- Poor - Huge bills and missed payments

- Worse - Unpaid debts and property at risk

- Worst - Unpaid debts with small income

Debt free solution

- Budgeting and bill payment

- Debt management plan

- Debt settlement program

- Chapter 13 bankruptcy

- Chapter 7 bankruptcy

Selected the debt free solution that works best in your current financial situation? Good. Now click on the solution on which you want to get help from OVLG.

Why you should get advice on debt free life from OVLG

Here are a few reasons why you should be getting debt free advice from OVLG.

- You get right advice on how to get debt free

- You get a list of debt solutions in 48 states

- You can compare and choose the right option

- Your personal information remains private

- You can get an idea of your expenses and savings

- There's a panel of attorneys to advise you

Client satisfaction level:* Client names have been changed to protect privacy

How to stay debt free life long

Staying debt free is as important as getting out of debt. To live debt free life, you should have an idea about your finances. Here are some steps you can take:

- Save whenever you can to build wealth

- Allocate your savings to different accounts

- Automate payments to keep your accounts in good shape

- Use different credit cards for specific purposes

- Pay off your credit card bills every month

- Adjust your budget as per your income and expense changes

- Track your personal financial performance frequently

- Resist temptations, control emotions and restrict expenses

8 Habits you should have for a debt-free life

So you want to have a life free of debt? But, what kind of habits should you practice every day? Find out on your own.

- 1 Ask for lower interest rates when you've good credit

- 2 Act as per your long-term financial goals

- 3 Ask for forgiveness whenever you're paying late

- 4 Ask financially successful people for free debt advice

- 5 Imagine you earn less and then make a budget accordingly

- 6 Reduce your expenses as per the budget

- 7 Set aside money for your emergency fund

- 8 Know your net-worth before signing papers

Debt free living tips you can't miss out

Here are the 5 debt free tips you shouldn’t miss out when creditors are knocking at your door for payments.

- Call at 800-530-OVLG to know how to be debt free

- Create a budget to find your path to financial freedom

- Increase your earning potential to pay bills and save as well

- Calculate how much you've to pay to be debt free

- Check out various debt solutions

How to become debt free fast in 5 years

Getting out of debt is far more difficult than getting into financial problems. Sometimes, it feels like debts would never go away from your life. But this isn’t true. With the right steps, you can attain financial freedom one day. However, if you want to start living a debt free life fast, then you have to be extra cautious. Recently, we spoke to a few financial experts to know about a few steps to become debt free fast in just 5 years. Here are a few of them.

- Negotiate with collection agencies: Irrespective of the amount you have, chatting with creditors is an effective step to lower your payoff amount. Sometimes, creditors agree to put you on a 5-year payment plan at a fixed interest rate when they feel that you’re in a genuine financial problem. This gives you a lot of relief since you know how much you have to pay and for how long. There won’t be any ugly surprises.

- Change your spending habits: Reckless spending won’t help you to live debt-free. You need to change your spending habits, and to do it, you have to create a budget first. A budget plan shows you where you’re overspending, where you can cut down expenditures, and save more money to repay your bills within 5 years.

Look at your budget and analyze each category. Find out where you can reduce expenses and change your spending habits accordingly. Some key areas where you can change your spending habits are cable, subscriptions, memberships, insurance, etc. - Get a side hustle: Many people say that the best way to become debt-free is to increase your income. Extra cash can help you in living a debt-free life. You can use it to pay off your debts.

Get a side-hustle to accelerate your income. Do a part-time job or start a small side-business to earn extra money and fulfill your financial goals. Sell unnecessary items online or drive for Uber or do freelancing to get extra cash. When you want to get out of debt fast, you need to make an extra effort. - Start making payments: After you have negotiated with creditors, it’s time to start making payments. Follow the repayment plan for 5 years. If the payment plan doesn’t work for you after a few months, then call 800-530-OVLG to settle or consolidate your debts. When your accounts are in best hands, you can live in peace. Our Financial Coach will negotiate with your creditors and create an affordable repayment plan to help you kick out debt within 2-3 years. You don’t even need to wait for 5 years.

Updated on: