Being bankrupt is a different ball game. By the look of it, you’re in a total financial mess, even though your cancer has been cured. Still, it’s a double whammy, where both your life and finances are at stake. That’s overwhelming.

Health care costs are galloping. And so is the plight of a growing number of cash-strapped people reeling under poorly-financed health insurance coverage.

As a result, people for want of quality health care are forced to file Chapter 7 bankruptcy to wipe out their medical debts.

Expert opinion!

Dr. Scott Ramsey, director of the Hutchinson Institute for Cancer Outcomes Research, or HICOR says,

“ It varies from cancer to cancer, but for those who are in a bankruptcy situation - and about 3 percent of cancer patients go bankrupt the risk of dying is just very, very high.„

Ezekial Emanuel, MD, Ph.D., associated with the Department of Medical Ethics and Health Policy at the University of Pennsylvania in Philadelphia says,

“ Patients should pay something but they shouldn't go bankrupt and put their family in financial distress when combating a life-threatening disease.„

Cancer care and medical bankruptcy

- Bankruptcy is the outcome of the financial burden caused by cancer on its victims. Bankruptcy can be tracked and calculated. Researchers study those data to conclude how rising cancer costs are affecting the society in general.

- Dr. Scott Ramsey reviewed a study published in 2013 and said that on average, cancer patients are 2.5 times more likely to file bankruptcy than normal people.

- According to the Journal of Clinical Oncology, cancer patients who break their banks are 80% more likely to die as compared to those who haven’t. Interestingly, some cancers drive higher mortality rates.

Diseased, indebted and overwhelmed

Cancer Survival Costs

Average cost of cancer diagnosis for a person is $146,000.

More than 65% cancer-related costs are indirect and not covered under traditional insurance plans, says American Cancer Society.

More than 50% bankruptcy cases are related to medical debt.

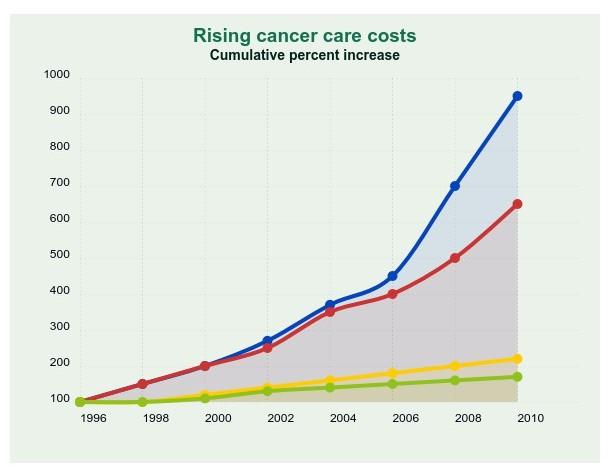

- Cancer care costs have skyrocketed. The same is for the out-of-pocket expenses patients are to bear.

- Insurance has become costlier. And that has worsened patients’ and their families’ financial condition. They can’t pay higher premiums, higher copays and higher deductibles for adequate health coverage.

- Cancer treatments demand loads of cash for surgeries, chemotherapy infusions, weeks of radiation, and so on.

- This is why many patients either deny getting treated or miss their sessions with the doctors. Stress, due to financial constraints, is another factor that rings true for worsening a patient’s woes.

Read: Medical debt stirs up the hornet’s nest: Disparate studies reveal so

Medical debt quicksand: Do providers help?

- Many providers either don’t deal with their patients’ financial burdens or lack the necessary information to do so.

- May be physicians ignore the outcome of their treatment. It pushes their patients towards bankruptcy which serves as the last resort to straighten-up their wretched finances.

- It's a collective responsibility of the provider community to support cancer patients and help them overcome the challenges as a society.

- Health-care is profit-driven. Patients with substantive insurance plans saw their out-of-pocket costs get inflated. The deductible (that could be reimbursed) amounts were slashed down. The network of both the providers and insurance companies are constricted. So, patients risk becoming an outcast.

The Affordable Care Act

People were able to access health care coverage better with the help of Affordable Care Act. It includes the people suffering from pre-existing conditions like cancer. Still, according to a survey, health care costs remain beyond the reach of many cancer patients.

Cancer-Care Cost Management: TIPS FOR PATIENTS

- Contact your health insurance company.

- Understand your coverage terms like deductible and copay well.

- Ask relatives, friends or an advocate to accompany you during your doctor’s sessions. You’ll have a close confidante to discuss cost issues on your behalf.

- Mention to your providers that treatment cost is a major issue to you. (Tweet This)

- Choose a therapy wisely.

- Discuss other alternative treatments with your providers.

- Save money by canceling unnecessary low-value tests (but only after consulting with a doctor) and other clinical procedures.

- A financial guide can help you and your family manage your cancer care costs.

- Use the patient assistance or patient access programs sponsored by some pharmaceutical companies. Some of them are Genentech Access Solutions, Roche Pharmaceuticals’ Rxhope, and Astellas Access Program.

- Take advantage of organizations like Patient Advocate Foundation that provide mediation, arbitration and negotiation services to cancer patients and their families. They can help to get proper care and fight on patient's behalf to pay off medical debt and retain jobs, both during and post cancer treatment.

- Several pro-humanity organizations can help you manage your cancer care as well as financial burden that conduct patient-welfare activities like Family Reach and Cents Program. These organizations collaborate with hospital social workers to cut down debt and minimize the emotional burden of cancer.

When all the above options have exhausted, and you find yourself dug deep into medical debt, then you can choose to file chapter 7 bankruptcy protection.

Medical debt under Chapter 7 Bankruptcy

- Medical debt is considered as a non-priority debt under Chapter 7 bankruptcy. (Tweet This)

- The trustee won’t place any priority to your medical debts while making any debt payments to your creditors.

- If a part of medical debt has been paid off through your bankruptcy, then any remaining outstanding medical bills will get discharged.

Limitations of Chapter 7 bankruptcy

- There’s no limit to the amount of medical debt you can cancel through Chapter 7 bankruptcy. But, you’ll have to qualify for the same, nevertheless.

- To qualify for a discharge, your income has to be low enough to pass the disposable income means test.

- Passing the means test and subsequently qualifying for a Chapter 7 bankruptcy discharge may not be your best option if you have a substantial amount of nonexempt assets.

Chapter 13 Bankruptcy - An overview

- Medical bills will be added to your debt repayment plan along with other unsecured debts.

- The total debt repayment amount will be decided based your income, costs, and nonexempt assets.

- Monthly debt amount will be distributed amongst your creditors on pro rata basis. You may be disqualified for a discharge under Chapter 13 bankruptcy if your total outstanding medical debt as well as other debts are more than the permissible limits mentioned in the bankruptcy code.

Related: What are the collection rules for medical debts?

Choose your antidote - Money or Life

Experts recommend a process where patients could access quality care.

Providers must focus on more important issues affecting the patient. They’ll have to execute the right treatment regimens, instead of prescribing extensive diagnosis and costly chemotherapeutic options.

Healthcare industry has to rethink its incentive mechanism and how cancer care costs will be paid.

Finally, doctors shouldn’t be paid for performing certain tasks, rather they should be compensated for providing the right care.