Holidays are perfect time to have fun with your families and friends. But this is also the prime time for spammers to steal your identity and make your holidays a complete disaster. An imposter may be using your personal information to obtain credit during these days when everyone is busy to complete their last-minute shopping. Above all, the whole mess can lower your credit score as negative items appear on your credit report.

If you think your credit score dropped for no reason, then you must read the article in order to recover from the deceitful activities.

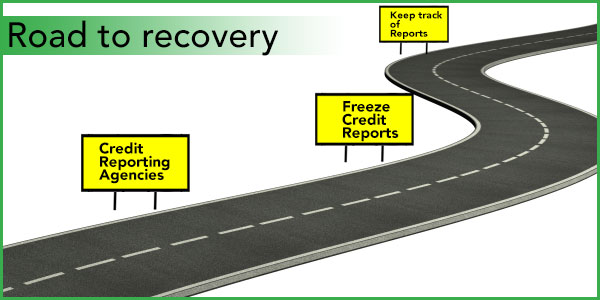

Steps to take when you're a victim of holiday identity theft

You can consider the following instructions to help you get back to your previous financial health.

#1 Report immediately to the credit reporting agencies

The situation that you are in should be immediately reported to the fraud departments of the 3 major credit reporting agencies - Experian, Equifax, and TransUnion. When you place a fraud alert, then your file is going to be flagged. This means that creditors have to call you before extending any credit in your name. As per the new provisions of the Fair Credit Reporting Act or FCRA, you can place a fraud alert for 90 days.

As an identity theft victim, the notice of your rights will be mailed to you by all the credit bureaus. After you receive this, you can request the bureaus to grant you a free copy of your credit report. You should also request them to let only the last 4 digits of your Social Security Number appear on your credit report. Another request that you can make is that you can ask for an extension in the fraud alert to seven years. However, you should know that to request this you have to have proper evidence of attempts that have been made to open fraudulent accounts.

#2 Freeze your credit reports

After getting an unexpected default letter, your first act should to freeze your credit reports. This prevents credit users from assessing your files without your permission. This also stops identity thieves from opening up new accounts and taking up credit cards in your name. In case you are an identity theft victim, a security freeze will be available to you for no charge at all.

#3 Keep a track of your credit reports immediately

Many a times, credit issuers do not give much attention to fraud alerts. Thus it is recommended that you keep a regular check on your credit reports. The FACTA law permits that you receive a free copy of your credit report every year from each of the three major credit bureaus. You can get them and keep track of your credit. You should remember that these measures that you will take are not enough to prevent rising debt that may be happening because fraudulent accounts are being opened by the imposter.

#4 Report to the police

Why should you pay debts that are not yours? If you have been a victim of identity theft and this has lead to an increase in debts that creditors claim are yours but are not, then you must report this to the local police. You must provide the police with as much as documented evidence as you can. Check to see that the police report lists the accounts that are fraudulent. There is a report that is called the identity theft report. You must ask for a copy of it. In case any creditor or anyone else requires any verification about your case, then you can hand over your investigators number to them. The identity theft report may also be required to verify the crime in front of credit card companies or banks.

Some quick actions a victim need to take

- Close any suspicious account of your name.

- Contact FTC.

- Request an immediate copy of your credit report.

- Do contact your accountant or financial advisor to take further action.

Some useful tips to remember during festive season

Try to to follow the basic tips in order to prevent the risk to become a victim if identity theft during holidays and over the year:

- Don't carry your social security card with you. Try to leave the card at house in a safe place.

- Try to monitor your bank statement, credit card bills and credit report. Maintain the same through out the year.

- Safeguard your receipt or bill. Don't throw away any bill or documentation filled with personal information without shredding.

- Increase your knowledge so that you can protect your kids from scammers.

Conclusion

These are few ways in which you can deal with identity-theft during or after holidays. It is a difficult situation as you are faced with creditors who want you to pay debts that are not even yours. Thus you must be very careful and follow the steps that have been mentioned if you want to get back your robust financial health.