“90% of my accounts went to collections a year back and my credit score dropped to 545.”

Amanda said it with a big frown on her forehead while sipping her favorite coffee at Starbucks last week. An event manager by profession, Amanda hardly has any time to take care of her personal or financial life. She is that busy. Work is her topmost priority in life.

Two weeks back, when Amanda received a collection call for a debt, she got startled. She had no idea of the fact that her account was in collections.

Yes, it’s a fact that she was late on a few credit cards. That’s what she knew when she checked her credit report 9 months back. But collection accounts? How could her accounts be in collections? Surely, she was not that late. She hoped that was the truth.

Unfortunately, that was the truth. Amanda’s worst fears came true when she checked her credit report. The debt was indeed in collections. And, the shock didn’t end there. There were 5 more accounts in collections and her credit score was 545.

Amanda was completely lost. Most of her debts had gone to collections a year back, and her credit score was in a very bad condition.

“I’m in deep trouble Stacy, and don’t have any idea of how to get out of it.” - sobbed Amanda.

I felt bad for Amanda and suggested her a few tricks to come out of this mess. When I came back home, it came across in my mind that there are millions of people who are in a similar situation, and I should share a few tricks with them.

So here I'm ready with this post where anyone whose debts went to collections a year back can learn a few tricks to rebuild credit.

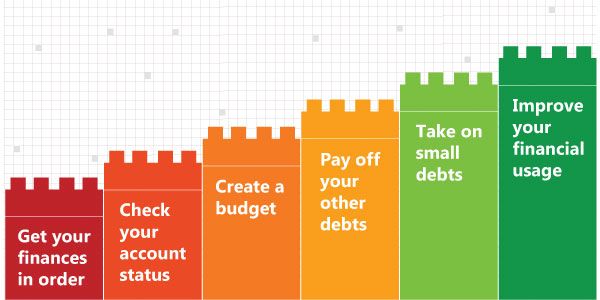

1. Get your finances in order:

This is the first step you should take to rebuild your credit. Start working sincerely, handle your basic expenses, and build an emergency fund to protect your already damaged credit. Surely, you wouldn’t want your credit to suffer more.

2. Check your account status:

Take a copy of your credit report from all the 3 credit reporting agencies - Equifax, Experian, and TransUnion. Find out how many accounts are in collections, and then take the following steps.

-

(i) Call the debt collectors:

You’ll get the contact details of the debt collection agencies in the credit report itself. Call the collectors and ask them to validate your debts in writing. Wait for 30 days and see if they can validate them.

-

(ii) Dispute account status:

Watch out for the collection accounts that couldn’t be validated. Dispute them with the collectors or the credit bureaus, and ask them to remove the accounts from your credit report. If credit bureaus or collectors don’t agree to delete them from your credit report, then you can consult an attorney or call our Toll-Free number 800-530-OVLG. Our attorney can help you deal with collectors breaking the federal and state laws.

-

(iii) Settle your collection accounts:

Once you have disputed the invalid collection accounts, you should focus on the valid ones. Contact the collection agencies and propose a rational debt settlement offer. If the collection agencies accept your offer, you're saved this time. But if the collection agencies are tough negotiators, then chat with our Financial Coach online, and let him negotiate with them.

Our Financial Coach has enough expertise to settle your collection accounts.

When your collection accounts are settled and updated on your credit report as 'Paid as settled' or 'Paid as agreed' or 'Paid in full' (if luck favors), prospective lenders will look at you with approving eyes when you apply for a loan.

Paid collection accounts have less effect on your FICO score. FICO score 9 ignores paid collection accounts. So once your credit report is updated, you can expect to see a gradual upswing in your credit score.

3. Create a budget:

A well-planned budget can help you achieve financial milestones smartly. It can help you to take care of collection accounts and your other debts by generating free cash from your income. It will show you the areas where you can spend less to save more.

Once you start saving money, it will be easier for you to pay off collection accounts and other bills fast. You use any good budgeting app for this purpose.

4. Pay off your other debts:

After you have paid off your collection accounts, you have to think of the ways to improve credit score. One good way of doing this is adding a positive payment history on your credit report.

Pay your utility bills, cell phone bills, grocery bills, cable bills, etc. on time to build a positive payment history.

5. Take on small debts:

The FICO score model will give you value when they see that you're a responsible borrower. Big loans are tough to deal with. But small loans or debts can be easily taken care of. And, when you make timely payments on them, it helps you to rebuild credit.

Apply for credit cards and maintain them responsibly. Don't cross the credit limit and pay your bills regularly. Take out a secured credit card and manage it properly.

6. Improve your financial behavior:

Open a savings account and deposit whatever you can every month. This fund is your emergency fund, and you should use it when you need to repair your car or home. You can also use it to make extra payments on your debts.

Never depend on payday loans or credit cards to pay off your existing debts or cover emergency expenses. An emergency fund may help you to avoid incurring fresh debts, which is extremely important for leading a good financial life. Too many debts can ruin your credit score.

So, that's all I had to say.

Do you know any other trick to rebuild credit when your debts have been assigned to collection agencies a year back? If so, share with us in the Disqus comment section. Our readers would appreciate it.