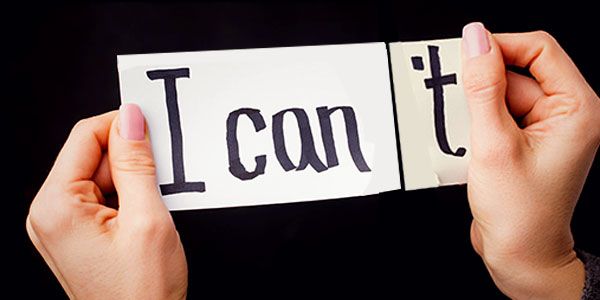

It is in our human nature to come up with excuses whenever we fail at something and are shy to accept the fact!

But how long can you carry on with your excuses?

How long will you be able to avoid the consequences of your failure?

No, I am not here to talk about ethics and to make you realize your mistakes.

What I want to do is point out to you your excuses for not clearing debts and explain why getting out of debt is hard!

What are your excuses for not being able to clear off debts?

1. You have too much of debt and you can never clear them for good:

If you are wise and smart, you can definitely clear your debts!

Then again you might say you are not smart enough and probably stand still with folded hands!

But think carefully, are you really not smart? This is just a mere excuse for running away from your debts.

Face it, man. Have a one on one battle with your debts.

Trust me, these debts are just lifeless numbers and you are a human with full of life!

Who’s more powerful?

Moreover, how will you know that you will never clear your debts if you don’t start making your payments?

Always remember these words of Samuel Beckett: “Ever tried. Ever failed. No matter. Try again. Fail again. Fail better”!

2. Your income is not enough to pay your debts:

This is an excuse that comes from people who don’t want to take steps to be financially independent. I seriously don’t want you to carry on with this excuse.

There are many things you can do to cope up with your debt payments.

You can use your spare time for a second job!

Or, you can downsize your lifestyle or decrease your luxury costs and use that extra money for the debt payments.

Also, you can sell off your unwanted items, and use that money to make extra payments toward debts or anything convenient!

If you are pretty much sensible, you will see how you have blocked your money on your own!

Probably you don’t need 2 cars or 3 credit cards, or you might have just bought too much of insurance.

Even after considering all the above factors you still feel that you don’t earn enough, then I guess it’s probably time to switch to another job that pays well.

But discussing which job suits you the best is out of syllabus for this post!

3. Paying off debts will hamper your savings and you will lose financial freedom:

I guess building savings and paying off debts are quite similar.

With savings, you are making consistent payments for which the award you will get in the future.

On the other hand, with debt payments, you already had your prize, but now you got to pay for it.

See it’s just the other way round!

Let’s come to the point.

Paying off debts can never hamper your savings. Only you have to consider the amount you pay for debts plus the amount you put for savings is your total liability.

This way you can maintain both savings and clear debt at the same time.

If becoming current on your debt payments takes away the room for savings, then let it be.

You can start your savings again anytime soon!

But these debts need to go away really fast!

Once you have cleared your debts, you will have ample time and space to experiment with savings!

Also, you are not going to lose your financial freedom if you do debt payments. You need to understand one thing very carefully; you can never be financially independent if you have debts around.

Debts mean you are dependent on something!

You are answerable to a third party for the decisions you make. Is that really being freedomized?

For an example, let’s say you don’t have enough money to pay for that Apple desktop, so you got to lean on your credit card for monetary help.

This makes you dependent and bound!

So, start clearing your debts and be financially independent!

4. Everyone has debts so you can have too!

Okay I will be very careful in explaining to you this part.

It is absolutely true and I can’t deny that more than 70% of Americans are in debt!

But ask all those who have debt including yourself, are they happy with drowning in debts?

Are they completely okay with so many debts, and if required, then filing a bankruptcy?

Let me tell you what all the debtors want. They want to be debt-free forever. Even if they don’t talk much about their pain, they are all fighting with debts, be it at night or in the day!

So as The Doors said- “Break on through to the other side”, break free your debts by putting an end to your excuses and start making payments in real time and real life!

Now that we have discussed in brief the excuses for not clearing debts, let’s see what are the real reasons that make debt payoff hard!

1. Becoming debt free demands sacrifices!

This is the real deal.

You seriously need to do many sacrifices if you want to get rid of debts fast.

The first among them is definitely maintaining a frugal lifestyle if your income is low!

Also if needed, you got to decrease energy consumption like electricity and gas costs!

So, whatever money you save by quitting your comfort zone, you punch it towards your debt payments!

2. Debt clearing takes time and that demotivates people!

How long your debts will take to go away from your life is determined by the amount of debts you have, what debt relief option you have chosen and what monthly payments are you making!

So, things won’t work if you start nagging in the middle of your debt payment course that why aren’t your debts getting cleared!

It takes time, sometimes several years to be debt free. Only if you have patience will you be successful!

3. It’s not only about debts but also interests!

Things would have been a lot easier if we had to deal only with the debt amount.

But these debt balls carry interest charges that grow with time!

So, this is a big reason that makes debt payoff difficult and tiring. If you just consider your mortgage loan, for instance, the first few years will go in clearing the interest amount!

4. Debt relief options are a bit complex and that makes debt clearing hard:

Debt consolidation, debt management or debt settlement, all these names baffle any common man who's already anxious and fear struck by debts.

But it is pretty easy to follow, once you enroll in any of the debt relief programs.

So, I would say that without wasting much time, you must start dusting your debts. More time you waste, more interests you have to pay.

If you are worried too much like which debt payoff method is helpful, then our team of experts at Oak View Law Group will help you out immediately.

Dial this number, anytime between 8: am to 8: pm - 800-530-6854 to be debt free!