Have you ever wondered just like I: What is the secret of a tremendous credit score?

The most trusted analyzer and preparer of credit score, the consumer arm of FICO – MyFico.com has recently published a rare report listing only those lucky folks who have made the impossible possible – who have managed to take their score to 785 and higher.

FICO scores range from 300 to 850. The higher your score is the better is you credit file and moreover, you are going to get a loan at favorable interest rate. Technically, your credit score is chiefly based on the information reported by lenders to the trinity - Experian, Equifax and TransUnion. It’s interesting but true that a persona may have multiple credit scores, depending on what kind of loan the person is seeking and which credit reporting bureau is doing the reporting.

According to the latest report released by myFico, more than 50 million people (which is about a quarter of all people having credit scores) have scores of 785 or higher and what is more striking, these people exhibit similar credit habits, regardless of social position, background and life experience . (The analysis has been done using data collected in April and FICO 8 scores, the latest version of the FICO software). Now, to exemplify these 50 million people, these are the people who keep low revolving balances, never max out their credit cards, and always make their payments on time.

However, these people are not free from the shackles of debt! Out of the total number, 1/3 have outstanding balances of $8,500 and more than that on non-mortgage accounts. And the rest have total balances of less than $8,500.

However, in spite of the fact that they carry high balances on their accounts, 96% of the mass don’t have any stain of missed payment on their credit reports. Though it may seem unbelievable, less than 1% of these people have an account past due.

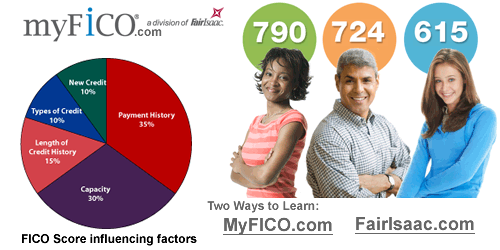

Payment history is one of the major determinant factors of your FICO score. 35% of your credit score is determined accounting this key ingredient. So this proves that making at least the minimum payments helps you achieve a high credit score.

It’s not that the reports of these excellent scorers are bump-free. One percent of the number has a collection mark on their report and about 1 in 9K has had a tax lien or filed for bankruptcy.

If we consider the average, these high scorers often keep their balances low and just make use of 7% of their revolving credit. Moreover, these people’s average credit account is 11 years old, which undoubtedly has helped them get an awesome score.

“While people with a high FICO score are not perfect, their consistently responsible financial behavior usually pays off over time,” Anthony Sprauve, credit score adviser for myFico, said in a statement.

So what are you thinking about?