A significant number of Californians are in a tight economic position. They are employed and have an excellent income but the costs of housing, transport and taxes take most of the income. This may result in defaulting on credit card payments, medical charges and other personal loans, which puts one under serious financial strain.

The biggest concern? I make too much money to qualify for bankruptcy. This is the only belief that prevents the majority of people from seeking help in any way.

In this article, you will find how you can pass the California Means Test with the help of legal methods, as well as how the high cost of living in the state directly impacts your eligibility and how the test works in practice.

Do I Automatically Fail the Means Test with a High Income?

The common misconception with the Means Test is that one with a high income cannot file Chapter 7 bankruptcy simply because of the high income earned. This is incorrect.

The Means Test is not an income cap; it is a calculating tool. It helps to determine whether you have any disposable income remaining after your non-negotiable expenses. It was intended to filter out filers: the ones who simply cannot afford to pay are referred to Chapter 7 (liquidation), whereas those who can pay something are referred to Chapter 13 (a repayment plan).

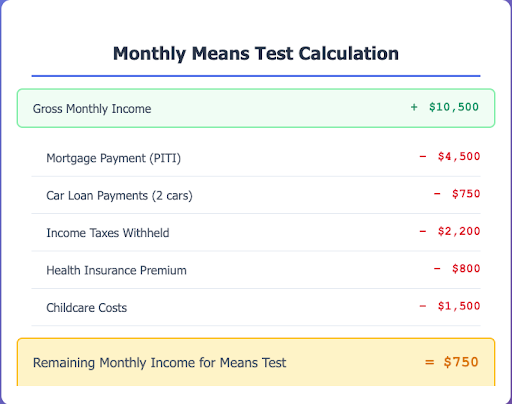

The formula for this calculation is:

Your Income - Your Allowed Expenses = Your Disposable Income.

The Means test also has the provisions of deduction of actual living expenses. These deductions are essential to the citizens of a high-priced state, such as California. Your Car loan, mortgage and taxes are not just expenses; they are deductions in the calculation of the Means Test, which indicates that you have less disposable income than your gross salary suggests.

What Is the First Step? Checking California's Median Income

The Means Test begins with a preliminary comparison. The gross income of your household averaged over the last six months is compared to the median income of a household of your size in California. The household income is a broad term and it involves salary, wages, bonuses, commissions, business income, rental income and even regular contributions to your expenses made by a spouse, partner or any other member of the family.

The regular contribution rule is significant: this normally involves the income of your spouse (although you may file separately), the contribution of an adult child who lives with you or even the rent payment of a roommate, since all these are part of the household's capability to pay.

You pass the Means Test and can proceed to Chapter 7 if your income is lower than the median.

The following are the data of the official statistics of the U.S. Department of Justice. These median incomes are revised after every six months (approximately April 1st and November 1st).

The table contains only valid cases which are filed between period November 1, 2023 and March 31, 2024.

| Household Size | Annual Income |

|---|---|

| 1 Person | $71,861 |

| 2 People | $92,781 |

| 3 People | $105,130 |

| 4 People | $123,451 |

(For each additional person, add $9,900.)

If your income is above the listed amount, you must complete the second, more detailed part of the test—unless you are exempt.

Did You Have a Failed Business?

Look before you proceed any further at what you owe. In case you have over 50 percent of total debt in the form of non-consumer debt, you are not subject to the Means Test at all.

- Personal, family or household consumer debts include mortgages, car loans, credit cards for grocery shopping and medical bills.

- Business debts are from a failed business, a business loan, a lease, a personal guarantee or business-related taxes.

When you have a failed business and most of the debt is due to that business, then you probably do not have to pass the Means Test in order to qualify to receive Chapter 7. This is a major difference that should be checked by an attorney.

How Exactly Do My California Expenses Help Me Pass?

In case you have a higher than median income (and the debts are primarily consumer), the Means Test will demand a thorough examination of your expenditures. This is not just a budget; it is a combination of your real expenses and amounts that have been established by the IRS as a standard. All legal deductions should be properly identified and recorded.

How Your Housing Payment Can Help You Pass

This is the most important deduction for the majority of Californians. In case you are a homeowner, the test permits you to deduct the entire amount of repayments of the secured debts. [Learn how to keep your house during bankruptcy in California.]

This is what you actually pay in mortgage and it includes:

- Principal and Interest (P&I)

- Property Taxes (T)

- Homeowner's Insurance (I)

This is a combination of PITI payment and any required HOA or condo fees that is fully deductible. With the real estate market being sky high in California, such a deduction can account for a massive portion of the income of an individual. In case you are renting, you are allowed to claim a standardized allowance on housing and utilities, depending on the county where you live and family size, as calculated by the IRS Local Standards.

What About Your Car and Your Commute?

The Means Test also appreciates that transportation is a need. It permits two distinct deductions relating to vehicles:

Secured Loan Payment: This is the entire monthly payment on your car loan or lease, which is deductible. This will be according to your real contract amount. You can frequently deduct both payments, provided you have two vehicles.

Operating Costs: You also receive a standardized expense allowance on non-loan expenses. This sum, established by the same IRS Local Standards, is to be used to cover expenses such as gasoline, oil changes, insurance and regular maintenance. The quantity depends on the region in California.

Never Forget the Taxes You Pay.

It is the sum of money that you actually get at the end of the day that counts and not your gross remuneration. The Means Test will enable you to subtract your actual monthly remittances from all the necessary taxes. This involves deductions on:

- Federal income tax

- State income tax (a major consideration in California)

- Taxes on Social Security and Medicare (FICA)

- Other required payroll deductions

This deduction correctly represents the sum of your paycheck that you cannot use to pay debts.

Beyond the House and Car: What Else Can You Deduct?

Many other necessary deductible expenses can significantly affect your eligibility. All of them should be taken into consideration. These include:

Healthcare: Your real monthly spending on health insurance premiums plus any regular or ongoing out-of-pocket medical expenses, such as prescriptions, co-payments or medical treatment required.

Childcare: This is the price of daycare, babysitting or other services that you need to work.

Court-Ordered Payments: These are payments you are under a legal obligation to make, including child support or alimony. These are classified as priority payments and are deductible.

Mandatory Retirement Contributions: When the contributions to a retirement plan are a mandatory term of employment, then such amounts can be deductible.

Term Life Insurance: A decent term life insurance policy has premiums that are deductible as well.

How Your High Income Can Disappear

To see just how effective these deductions are, the table below shows how they could cut down what might appear to be a high income by a large percentage to a level that can be passed through the Means Test. It is important to note that the top-line figure of income is not the important part but what you have remaining after all legally permitted expenses are subtracted.

As you can see, $126,000 of annual income can translate to as little as about $750 per month in disposable income once all legally permitted expenses are totaled. It is this drastically lower figure that the court frequently relies upon in its analysis, which proves that your gross salary is hardly the determining factor.

What Can I Do If I Fail To Pass The Test?

In case the formula indicates that you have a lot of disposable income left after making all the deductions, you can choose other alternatives. This is the situation that Chapter 13 bankruptcy is meant to address. It is an organized manner of handling your debts in the custody of the court.

The Means Test can be applied in a Chapter 13 case as a calculator. The amount of disposable income that it will generate assists in determining the amount of minimum monthly payments you are going to make in a 3-to-5-year repayment plan. This process provides various valuable safeguards and advantages:

Stop All Creditor Actions: An "Automatic Stay" is a legal requirement that once filed, creditors must immediately cease all collection efforts. That consists of foreclosures and repossessions, garnished wages, legal suits and telephone calls.

Keep All Your Assets: Chapter 13 is designed in such a way that you can retain your property, such as your home and car. If you are late in making mortgage payments, the plan will enable you to pay the arrears within a period of time.

Consolidated Monthly Payments: You pay monthly to a court-appointed trustee. Your trustee then allocates the money to your different creditors as per the conditions of your confirmed plan. This makes your financial life easier.

Wipe Out Remaining Debt: After a successful plan, all unsecured debts that have not been discharged, like credit cards and medical bills, are wiped out completely.

What Should I Do in Case I Fail the Test under Special Circumstances?

When the math on the Means Test form indicates that you have disposable income, you do not necessarily get disqualified. The law gives you the right to make a rebuttal under special circumstances.

It is a procedural manner of informing the court that your present 6-month average is not a true reflection of your reality.

In order to succeed, you will have to demonstrate that you have other required expenses or a change of income that is not reflected by the standard form.

Common examples include:

- Recent dismissal or a huge reduction in salary.

- A call to active duty or to the Armed Forces.

- A deep medical ailment with substantial ongoing, out-of-pocket expenses.

- Suddenly, there are necessary expenses for an elderly parent or family member.

- Tax liabilities that are not yet fully recorded on the form.

What If My Income Changes After I File Bankruptcy?

This is a critical and common question. The Means Test is a financial snapshot of your finances using the past 6 months leading up to the time you are filing.

In a Chapter 7 Case:

An increase in your income following your filing does not usually have an impact on your case. Your qualification was decided on the basis of your previous income. The issue that the court primarily focuses on is that you have revealed all your assets and reported truthfully about your income during filing.

In a Chapter 13 Case:

The Chapter 13 plan takes between 3 and 5 years. In case you get a substantial, non-temporary rise in your earnings (such as a large raise or a new, better-paid job), the trustee in bankruptcy or a creditor may move to alter your plan. This might translate to an increase in the amount of money that you pay monthly to repay your creditors more.

On the other hand, in case your income goes down, your attorney can request that your payments be reduced.

Should I Do the Means Test Myself or Hire a Lawyer?

Although online calculators are available, the Means Test is a complicated section of the bankruptcy code and the accuracy is paramount. Even a simple calculation error or misunderstanding can have serious consequences:

- Case Dismissal: A petition filed incorrectly can be dismissed by the court.

- Loss of Opportunity: You may wrongly assume that you cannot get Chapter 7, when a proper accounting of your expenses could have allowed you to qualify.

- Trustee Objections: Mistakes may also make the bankruptcy trustee suspicious and ask hard questions and even challenge your case.

One missed deduction may make the difference between qualification in Chapter 7, where the debt can be discharged in full and being forced to go into a 5-year Chapter 13 plan.

A qualified bankruptcy lawyer in California knows how to translate the right local and national standards and record your costs to paint an accurate financial portrait in court.

Frequently Asked Questions

A: Yes, generally speaking, your income is added together with that of your spouse to make your household income. Nevertheless, their personal expenses on their personal debts and needs are also deducted.

Technically, no. When the income is lower than the median by one dollar, you pass. But in the first place, it is very close to the threshold, which may attract additional attention from the bankruptcy trustee.

They can reexamine your filing to make sure that you did not, say, deliberately underestimate your income in the months preceding filing just to make ends meet.

This is referred to as a bad-faith filing. When you are under $ 500, it does not really matter. It is always best to be open and candid.

This is a critical point. Your latest pay stub is not used in the test. It applies your mean gross income during the past six full months (the look-back period). This can be a great benefit in case your income has just decreased, because you can time your filing.

For example, you might want to wait 3 months more in case you lost a high-paying job three months ago. This enables the high-income period to drop off the 6-month average and hence it is significantly easier to pass.

This is a common trap. In the case of the Chapter 7 Means Test, the response is sadly no. Courts (particularly in the Ninth Circuit, which includes California) have determined that repayment of a loan to oneself is not a necessary expense or a secured debt.

The amount of that payment will be reflected in your disposable income, although it is automatically subtracted from your paycheck. In Chapter 13 plans, however, they are frequently allowed.

Bottom Line

Your gross income is not the deciding factor in your financial future. California, the real cost of your life is what counts: that colossal mortgage, the monthly car payments and high state taxes.

The Means test is complicated and as we have discussed, each deduction matters. One expense or one exemption missed can be the difference between qualification in Chapter 7 to discharge all of the debt and being locked into Chapter 13 to a 5-year payment plan.

Disclaimer:

This article is for informational purposes only and does not constitute legal or financial advice. Reading this information does not create an attorney-client relationship. Laws change frequently, and you should consult a qualified attorney in your state for advice on your specific situation.

Sources

U.S. Department of Justice, U.S. Trustee Program: https://www.justice.gov/ust/means-testing

U.S. Department of Justice, Median Income Data (for cases filed Nov. 1, 2023 - Mar. 31, 2024): https://www.justice.gov/ust/eo/bapcpa/20231101/bci_data/median_income_table.htm