The rules of the game has changed. Only time will tell whether it did for good or for bad as the news of a sharp increase in interest rates applied on student loans begin to sink in on the masses. The cost of higher education has finally risen once again, thanks to the antics of the White House and the country’s lawmakers.

Students, who’s batting in your favor?

Students and graduates while you lick your wounds, please find solace in U.S. Senator Claire McCaskill’s bill named Bank on Emergency Loan Refinancing Act. The prime objective of this bill is to lower your debt burden by decreasing the rate of interest applied on student loans.

In a press release, McCaskill was quoted as saying that,

"For thousands of Missouri’s young people, staggering student loan debt is strangling the economic opportunities that are supposed to come with a college degree - every dollar paid in interest on that debt, is a dollar not invested in a small business or a new home". She further added that,"I personally benefited from student loans when I was in school, and I’ll continue fighting to make sure that every student who works hard gets a fair shot at an affordable college education".What’s the change?

The recent hike in student loan interest rates have already gone into effect from 1st July. Though federal fiscal year officially starts from 1st October, yet the Department of Education needs to follow a directive that requires informing those affected and the public in general about the new rules. Moreover, it helps them to gather feedback regarding legislations of this sort from the masses.

The changes are as follows:

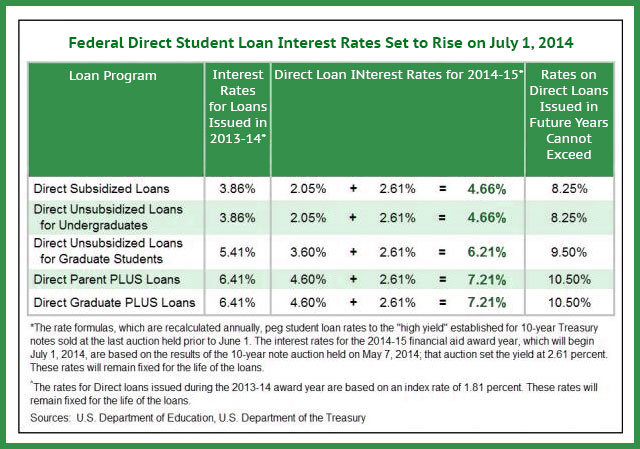

Increased interest rates - In 2013, the Congress amended the law that decided interest rates to be applied on federal student loans. It has been determined on the basis of 10-year Treasury note’s rate and it was the last auction in May along with a small portion added to it. However, that same rate this year, 2014 is 2.61 percent. An eight-tenth of a percent increase since 2013.

As per the latest rule, a fresh loan that has been disbursed on or after 1st July 2014 will originate with the current rate of interest and would remain fixed for the entire term of the loan. Fortunately, interest rates on recent fixed rate loans and that includes consolidation loans will be kept untouched.

Advantage of closed-school discharge - The timing of this announcement couldn't have been better because Corinthian colleges were about to shutter their 107 campuses all across the country within a couple of weeks from now. As a result, a disaster was averted that would’ve severely affected students who’d have nowhere to go all of a sudden. Right now, students enjoy upto a certain degree of security for having federal student loans. Earlier, a student whose enrollment happened within 90 days of his or her school’s closure and failed to complete the necessary credentials at another school, then he or she would be discharged of the associated loan’s liability.

Here, the new rule has just expanded that period from 90 to 120 days from the date of a school’s closure. Make sure that the school or college is almost eligible for a successful discharge. In case, you’ve been provided with a chance to complete your course credentials, then you should do so and complete your degree.

Freedom to federal student loan defaulters - There are two ways to resolve this issue, i.e., either you can choose to get a rehabilitation package or opt for student loan consolidation. There’s a catch here for the defaulters: you must have made at least nine consecutive monthly payments on-time that are affordable and are of reasonable amount as agreed by both the lender and you. Fresh legislations in this matter will streamline the rehabilitation process and give it a solid framework for all the borrowers to wade through their delinquent loans, irrespective of their loan holders.

The new rule stipulates that the rehabilitation process for borrowers applying on or after July 1 will have to pay an initial amount calculated as per the 15 percent guideline. This means, as a borrower to calculate the monthly payable amount, 15 percent of your disposable income will be taken into consideration. Still, if the amount becomes unaffordable for you, then you are welcome to submit a financial hardship form that would require a better and more closer look at your overall financial condition.

Fresh income-based repayment options - Finally, by the help of his executive powers, President Barack Obama has released an executive order to extend the lifeline of an income-based student debt relief program known as “Pay As You Earn”. This program will be available to borrowers with older loans. Unfortunately, if you take out your first loan now (that is on or after July 1), then you’ll be eligible for the income-based repayment plan with just a 10 percent cap regarding your monthly payments and not 15 percent, out of your disposable income.

The good news here is that your outstanding debt will be forgiven after 20 years of regular monthly payments and not 25 years.

The Congress has also come up with rules concerning the government’s wage garnishment process. This move has been taken to ensure that all borrowers are treated at par to one another.