Imagine two friends, both age 25, who dream of retiring comfortably at 65. Sarah starts investing $300 a month while Tom waits until he's 35 to begin saving the same amount. By the time they retire, Sarah has over $1 million in her retirement account while Tom has just over $440,000. What made the difference? The power of compound interest.

Albert Einstein reportedly called compound interest the "eighth wonder of the world," and for a good reason. It's the secret weapon that can help you turn modest savings into a substantial retirement nest egg over time. In fact, a recent study found that starting to save for retirement just five years earlier can boost your ending balance by over 50%.

But what exactly is compound interest and how does it work? More importantly, how can you harness its incredible potential to supercharge your retirement savings? In this article, we will explore compound interest and its impact on retirement planning. We'll also cover ways to use this powerful financial tool.

What Is Compound Interest?

Compound interest is the interest calculated on the initial principal and the accumulated interest from previous periods. In other words, it's "interest on interest." This means that your money grows faster over time because you're earning interest on a larger sum each compounding period.

Simple Interest vs. Compound Interest

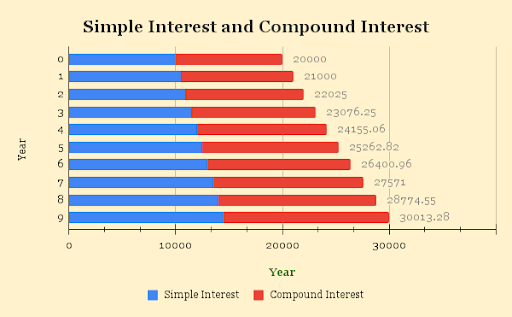

To understand the power of compound interest, let's compare it to simple interest:

- Simple interest is calculated only on the initial principal amount. If you invest $1,000 at a 5% annual interest rate, you'll earn $50 in interest every year.

- Compound interest is calculated on the principal amount and the accumulated interest. Using the same example, if the interest is compounded annually, you'll earn $50 in the first year, $52.50 in the second year, and so on. Each year, your interest earnings grow.

The Power of Compound Interest Over Time

The longer your money has to grow, the more powerful the effects of compound interest become. Here's an example:

- If you invest $10,000 at a 7% annual interest rate, compounded annually, you'll have:

- After 10 years: $19,671

- After 20 years: $38,696

- After 30 years: $76,122

As you can see, the growth accelerates over time, making compound interest a powerful tool for long-term savings goals like retirement.

How Compound Interest Affects Retirement Savings

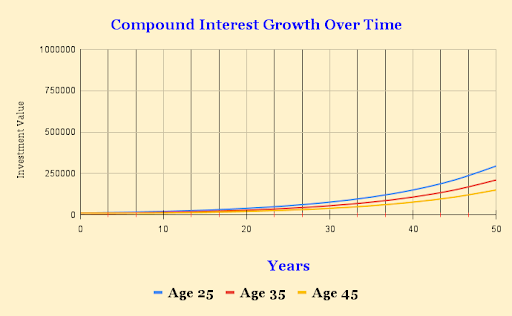

Starting Early Benefits

Time is key for compound interest. The earlier you start saving for retirement the more your money grows.

Example:

- Sarah invests $200 monthly at 25 earning a 7% annual return. At 65 she has $613,488.

- John starts at 35 doing the same with a 7% annual return. At 65 he has $277,620.

Sarah invested only 10 years more but has over twice John's amount due to compound interest at the same 7% annual return.

Consistent Contributions Matter

Regular savings even small ones add up over time with compound interest.

Example: Investing $100 monthly at a 7% annual return gives you:

- After 10 years: $17,308

- After 20 years: $52,093

- After 30 years: $121,997

Increasing your savings as you earn more boosts your retirement fund especially when earning a 7% annual return.

Growth Potential Examples

- Emily saves $5,000 yearly at a 6% annual return. After 30 years she has $419,008.

- David saves $10,000 yearly at an 8% annual return. After 25 years he has $789,544.

These examples show how different saving amounts and annual returns affect long-term growth.

The Rule of 72

The Rule of 72 helps you estimate how long it takes for your investment to double. It's a simple tool for planning your retirement savings.

How it works:

Divide 72 by the yearly interest rate. This gives you the number of years to double your money.

Example: If your investment earns 6% yearly it will double in about 12 years (72 ÷ 6 = 12).

You can also use it backwards: To double your money in 8 years you need about 9% yearly return (72 ÷ 8 = 9).

Remember: The Rule of 72 assumes steady returns. It doesn't account for inflation taxes or changing returns. But it's still useful for quick estimates.

Using the Rule of 72 in retirement planning:

- Set realistic growth expectations based on your likely return rate.

- See how different return rates affect doubling time. Adjust your savings if needed.

- Use this rule with other retirement planning tools to create a full strategy for your goals.

This simple rule can help you understand and plan your investment growth over time.

Factors That Influence Compound Interest in Retirement Planning

Several things affect how your retirement savings grow through compound interest.

Here are key factors:

Investment Returns

Your investments' growth rate is crucial. Higher returns mean faster growth. Lower returns mean slower growth.

Example: If you invest $10,000 for 30 years:

- 5% yearly return gives you $43,219

- 7% yearly return gives you $76,122

- 9% yearly return gives you $132,676

This shows how a small difference in return rate can lead to a big difference over time.

Choose investments that match your risk comfort and goals. Higher returns often come with higher risk. Lower-risk investments usually have lower returns.

Remember investing involves risk. Past performance doesn't guarantee future results. It's important to diversify your investments and regularly review your retirement strategy.

Time Horizon

How long your money grows is key for compound interest. The longer it grows the more it can increase.

Example: Invest $10,000 at a 7% yearly return:

- For 10 years: you get $19,671

- For 20 years: you get $38,696

- For 30 years: you get $76,122

This shows why starting to save early for retirement is important. More time means more growth.

Contribution Amounts and Frequency

How much and how often you save also affects your money's growth through compound interest.

Example: Invest monthly at a 7% yearly return for 30 years:

- $100 per month: you end up with $121,997

- $200 per month: you end up with $243,994

- $500 per month: you end up with $609,986

Increasing your savings even a little can make a big difference over time. Try to save more as you earn more.

Remember these are examples. Real investment returns can vary. It's important to regularly review and adjust your savings plan based on your goals and situation.

Taxes and Fees

Taxes and investment fees can slow down your retirement savings growth.

Example: Invest $10,000 at 7% yearly return for 30 years:

- Without fees: you end up with $76,122

- With a 1% yearly fee: you end up with $57,435

The 1% fee reduced your final amount by $18,687. This shows how fees can significantly impact long-term growth.

Tax-deferred accounts like traditional IRAs can help. They let you avoid paying taxes on returns until you take the money out in retirement. This allows more of your money to grow over time.

To make your money grow faster through compound interest:

- Look for investments with low fees

- Use tax-efficient accounts when possible

- Understand the tax implications of your investment choices

Remember tax laws can change. What's tax-efficient now might not be in the future. It's a good idea to review your strategy regularly with a financial advisor.

Different types of accounts and investments have different tax rules. Some may be taxed yearly while others are taxed only when you withdraw. Understanding these differences can help you make better choices for your retirement savings.

Strategies to Maximize Compound Interest for Retirement

Now that we understand what influences compound interest, let's explore strategies for maximizing its potential for your retirement savings.

Start Investing

Early Beginning is one of the most powerful ways to harness compound interest. Even small initial savings can grow significantly over time.

"The best time to plant a tree was 20 years ago. The second best time is now." - Chinese Proverb

Make Consistent Contributions

Consistently contributing to your retirement savings is key. Set up automatic contributions from your paycheck or bank account to stay on track.

"Do not save what is left after spending but spend what is left after saving." - Warren Buffett

Invest in Tax-Advantaged Retirement Accounts

Tax-advantaged accounts like 401(k)s and IRAs can help your money grow faster by deferring taxes on contributions and earnings until retirement.

- If you have a 401(k), contribute at least enough to get any employer match. It's essentially free money.

- Consider opening a traditional or Roth IRA if you don't have a 401(k) or want to save more.

Choose Appropriate Asset Allocation

Asset allocation means dividing investments among different asset classes like stocks bonds and cash. Choose based on your risk tolerance and time horizon to maximize returns while minimizing risk.

- Younger investors with longer time horizons can usually take on more risk.

- As you near retirement shift to a more conservative allocation to protect your savings.

Regularly Rebalance Your Portfolio

Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. This helps you stay on track and avoid taking on more risk than you're comfortable with.

- Many retirement accounts offer automatic rebalancing.

- Or you can rebalance manually once per year.

Avoid Excessive Fees and Taxes

Minimizing fees and taxes is crucial for maximizing compound interest. Look for low-cost investments like index funds or ETFs. Be mindful of trading frequency to avoid unnecessary taxes and transaction costs.

- Even small differences in fees can add up to thousands of dollars over time.

By implementing these strategies you can make the most of compound interest and build a stronger retirement nest egg over time.

Common Mistakes to Avoid

While understanding compound interest is key for retirement planning it's also crucial to know common mistakes that can slow your progress.

Let's look at some of these mistakes and how to avoid them.

Delaying Retirement Savings

A common error is postponing retirement savings. Many think they'll start "later," but as case studies have shown, starting early makes a big difference.

"The best time to start was yesterday. The next best time is now." - Unknown

Even if you can only save a little at first beginning as soon as possible is vital to maximizing compound interest benefits.

Not Contributing Consistently

Another mistake is inconsistent contributions to retirement savings. It's tempting to skip saving when money is tight but this can greatly impact long-term growth.

To avoid this:

- Make retirement savings a priority in your budget

- Set up automatic contributions to help you stay on track

By avoiding these mistakes you can better harness compound interest for your retirement savings. Remember early and consistent saving can significantly boost your retirement fund over time.

Chasing High-Risk Investments

While it's crucial to choose investments that match your goals and risk tolerance, chasing high-risk investments for bigger returns can be dangerous.

"Risk comes from not knowing what you're doing." - Warren Buffett

Instead of trying to beat the market focus on creating a well-diversified portfolio balancing risk and return based on your individual needs.

Neglecting to Diversify

Diversification is key for successful investing but many make the mistake of putting all their eggs in one basket. Spreading investments across different asset classes and sectors can help reduce risk and boost long-term success chances.

- Create a mix of stocks bonds and cash aligning with your goals and risk tolerance

- Consider index funds or ETFs for broad exposure to various markets and sectors

By avoiding high-risk chasing and diversifying properly, you can better protect and grow your retirement savings. Remember a balanced approach often leads to more stable long-term growth.

Conclusion

Compound interest is a powerful tool for growing retirement savings but it needs understanding and action to reach its full potential. By applying these principles, you can harness compound interest to build a more secure financial future. Remember, taking action now on these insights can lead to a more comfortable retirement. Whether you're just starting or adjusting your current strategy every step towards smart saving and investing counts.

Remember retirement planning is a journey. Regularly review and adjust your approach as your circumstances change. With patience and discipline compound interest can work wonders for your retirement savings.

Frequently Asked Questions (FAQs)

Simple interest is calculated only on the principal amount. Compound interest is calculated on both the principal and accumulated interest. This makes compound interest grow your money faster.

Compound interest can be calculated annually semi-annually quarterly monthly or even daily. More frequent compounding means faster money growth.

Key factors are the initial investment amount, regular contributions, interest rate or return rate, investment time length, and compounding frequency.

Both can work well. However, smaller regular contributions are easier for most people and help smooth out market ups and downs.

Start early make consistent contributions use tax-advantaged accounts choose appropriate investments minimize fees and regularly review your portfolio.

It's never too late to benefit from compound interest. Focus on larger contributions and consider higher-return investments to boost savings.

Invest in assets that may outpace inflation, such as stocks, real estate or Treasury Inflation-Protected Securities (TIPS). Diversify your investments across different types of assets.

Additional Resources

Check out these helpful resources:

- Retirement Planning Calculators: Vanguard's Retirement Income Calculator

- Compound Interest Calculators: Investor.gov's Compound Interest Calculator

- Retirement Planning Guides: Kiplinger's Retirement Planning Guide

- Investment Education: The Balance's Beginner Investing Guide

-

Retirement Planning Books:

- The Bogleheads' Guide to Retirement Planning - by Taylor Larimore, Mel Lindauer, and Richard Ferri

- How Much Money Do I Need to Retire? - by Todd Tresidder