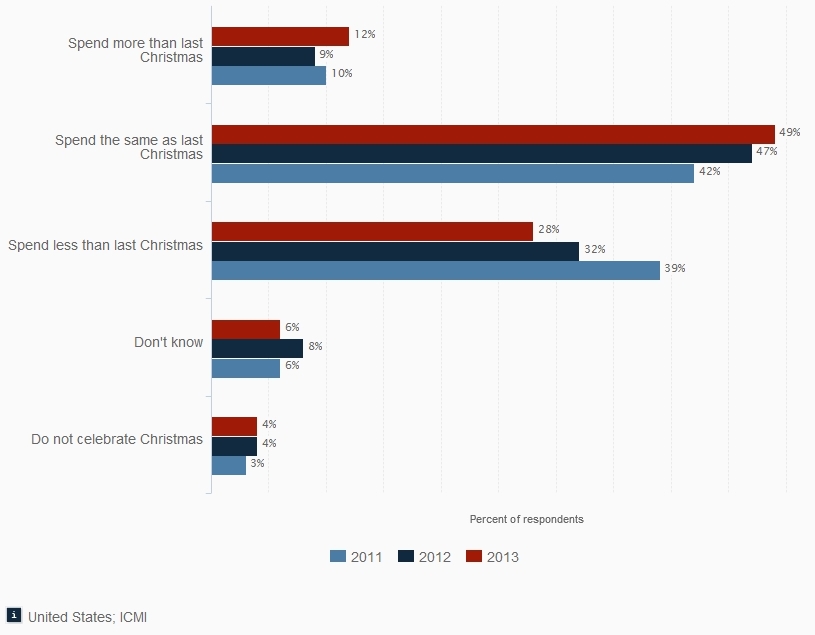

A recent survey on US consumer spending habits during Christmas shows that 40 percent Americans plan to spend the same amount as last year. In fact, an alarming 12 percent this year plan to spend more. This wouldn't have been as alarming had it not been for the source of expenditure. US citizens use credit cards to buy gifts and toys during the Yuletide. This is why credit card usage reaches its peak during Christmas. The average US household credit card debt stands at 15,279 dollars. The Federal Reserve statistics also show that an average household owes 7,218 dollars on its cards.

This recurring trend of growing household debt after Christmas needs to be addressed if you wish to enjoy a debt free Christmas. There's no point in adding to your credit card debt. Of course you'll continue using your plastic money, but a tad more tactfully.

5 Tips to use your credit card carefully this Christmas

Surely you don't wish to receive huge amounts of credit card bill after Christmas. Neither would you like to add to your average household debt. At the same time you should also enjoy this Christmas. The following tips help you do the same -

- Make a shopping list: The very first thing to do is make a shopping list. Go out and use your credit card to buy gifts and toys, but stick to your pre-planned shopping list.

- Always compare shops: Make use of your smartphone or tablet to find the best deals for your purchases. In this manner you'd save a lot on your credit card expense.

- Use those coupons: Always be on the lookout for coupons. The idea is to buy as many Christmas gifts you can with the coupons. This lessens the burden on your credit card bill.

- Don't buy decorations and food: Don't use your credit card for buying food and decorations. You can make these at home. Include friends and family in crafting decorations and baking. It'll be great fun.

- Don't go with the frenzy: Last but not the least, don't go with the frenzy all around. Using your credit card without a thought can suck you into a deep debt hole. Climbing out of it isn't going to be easy. So stick to limited spending with your credit card and enjoy Christmas to the fullest.

It's Christmas and the time for celebrations. All it takes is a little bit of caution with your credit cards and you can enjoy even after. Merry Christmas!