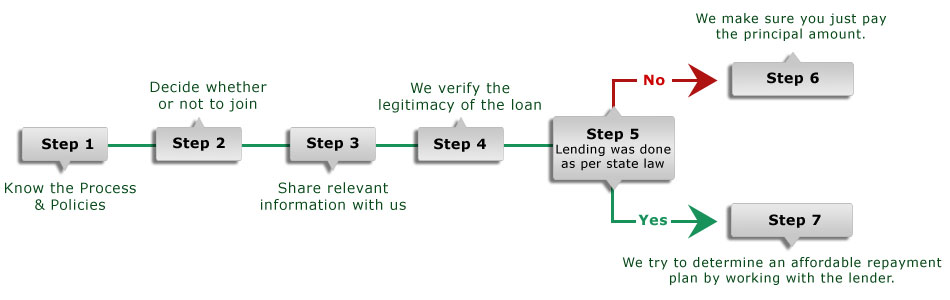

How OVLG processes payday loan debts in 7 simple steps

OVLG is there to help you out when you’re immersed in payday loan debts. Check out the 7 steps through which OVLG processes your payday loan debts.

Step 1: OVLG's Financial coach will explain you about:

- OVLG payday loan process

-

OVLG policies such as

- No result refund policy

- Dedicated CRA (Client Relationship Associate) who will handle your case

- Fee structure

Step 2: You have to decide if you want to become a client of OVLG after clearing your doubts regarding the OVLG process and policies from the Financial Coach.

Step 3: Your CRA will collect the following details from you:

- Name of your state

- Name of the payday loan company

- Date on which the loan was issued

- Terms of the loan such as principal amount, interest rate, fees, etc.

-

Mode of payment: Your CRA will ask if the loan payments are:

- Collected through ACH transactions

- Collected at store

- Payments made towards the loan

- Current balance claimed by the payday loan company

Step 4: The CRA will work closely with an attorney licensed to practice law in your state to determine the legality of the payday loan issued to you. Please understand that a blank judgment about a payday loan company cannot be made. You need to determine the legality of a specific loan first.

Step 5: If it is found that the lending was executed illegally, then your CRA will work with you to ensure that only the principal amount is paid to the payday loan company.

Step 6: If it is found that payday lending is legal in your state, then the CRA will determine the maximum interest rate you have to pay after discussing with an attorney.

Step 7: Once the maximum interest rate is determined, the CRA will either set up a payment plan or offer a lump sum settlement with the payday loan company.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult a qualified attorney for advice on your specific situation.

Updated on: