Pay-for-deletion agreement letter to remove negative information

Those with a less-than-stellar credit report who are trying to improve their financial situations often wonder if and how they can remove negative information from their credit reports. Negative remarks on your credit report can result from late payments, charge-offs, credit inquiries, and overdue account citations.

Thanks to the Fair Credit Reporting Act, consumers have the legal right to challenge inaccurate information on their credit reports, but what happens if the negative remarks are true? This calls for a new strategy. A pay-for-delete offer can be an effective way to eliminate negative remarks from your credit report.

A pay-for-deletion letter is one of the few options available for attempting to have errors made previously removed from public view.

What is pay-for-deletion?

A pay-for-delete agreement is called a pay-for-delete agreement when a borrower agrees to repay their debts in exchange for having them removed from their credit report. Most of the time, collection accounts will stay on an individual's credit report for up to seven years after the date the borrower defaulted on the loan.

It's something to consider when trying to negotiate a debt settlement agreement. As part of the agreement, you agree to give a specific sum of money, and in return, the collector will remove the collection accounts from your credit file. Debt collection representatives might insist on full payment before removing the remarks.

The collection agencies must provide complete and accurate data to the big three credit reporting agencies (Equifax, Experian, and TransUnion). Therefore, credit bureaus, credit unions, corporate banks, etc., frown upon the practice of pay-for-delete offers because of the questionable nature of the underlying transaction. Even though the Fair Credit Reporting Act doesn't explicitly prohibit pay-for-delete, some collection agencies still do.

What is a pay-for-delete letter?

Borrowers may pursue pay-for-deletion by contacting the collection agency or writing a formal letter, also known as a pay-for-deletion letter, to the agency. In your pay-for-delete agreement letter to the collection agency, you should clarify that you are willing to repay the total outstanding debt or part of it in exchange for the debt being removed from your credit. Once the proposal is received, the collection agency can decide whether or not to remove the remarks.

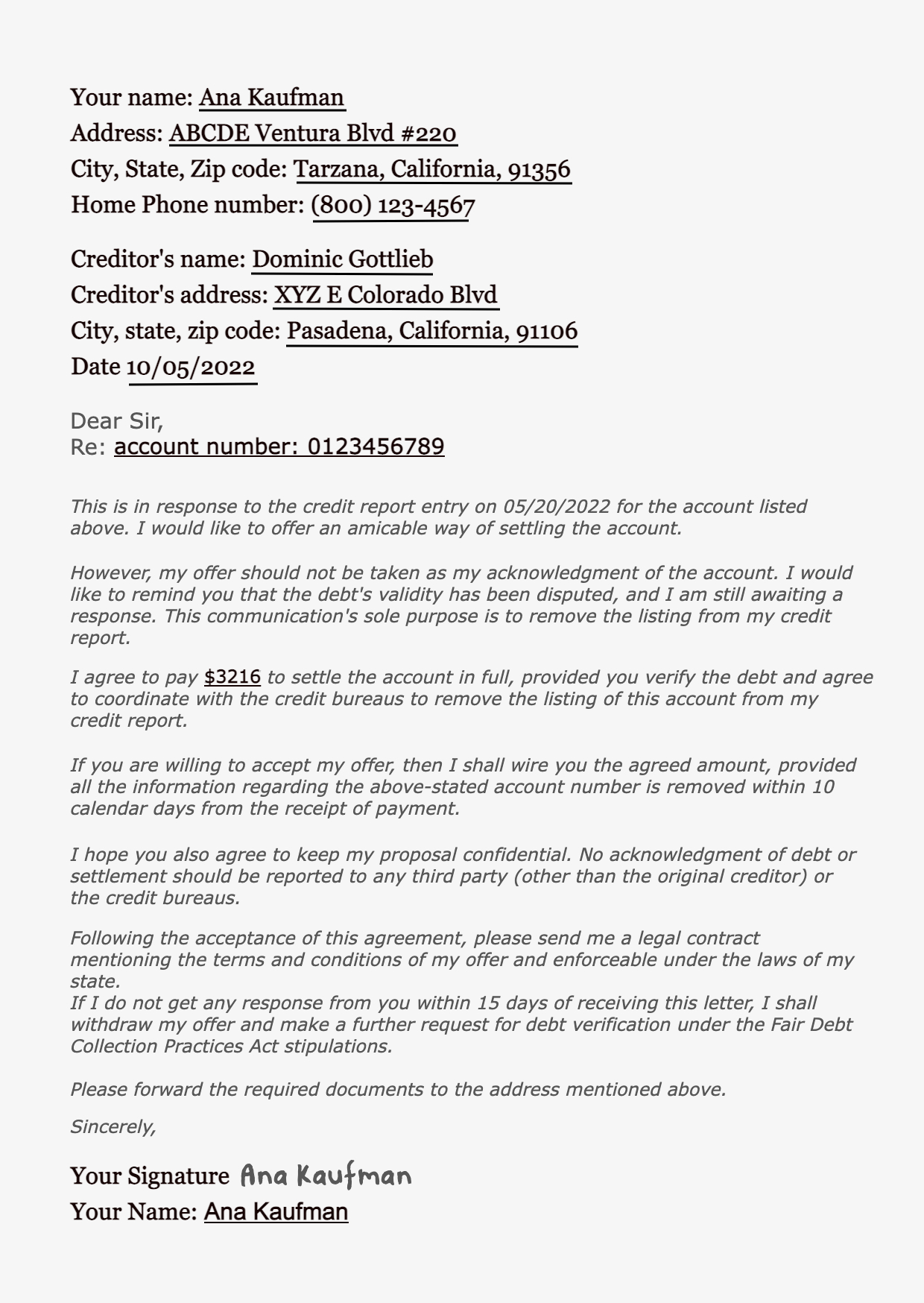

Sample for pay-for-delete letter

With the help of this sample pay-for-delete letter template, you can send the offer to your collection company and ask to have the negative information removed from your credit history.

Things to consider before sending a pay-for-deletion letter

Check the statutes of limitations for your debt

It's essential to check the statute of limitations associated with your debt. Make a note to do so before discussing your debt further. Is it a long overdue debt that will soon be forgiven? In these circumstances, there is no need to send a pay-for-delete letter because the debt will be erased from your credit report once the grace period ends. Sending a pay-for-delete letter could be an option if the deadline for the statute of limitations to end is still far off.

Make sure the debt collector has the right to collect the debt

Make sure the debt is legitimate and it is the debt that you owe. The collection company has the legal right to collect from you before making a pay-for-delete offer. If your first contact with the collector was within the past 30 days, you could ask for confirmation of the debt by sending a debt validation letter. Make sure you ask them to mention your total debt.

When a debt collector cannot provide adequate proof of a debt, they are legally prohibited from taking any action against you, including reporting the debt to a credit reporting agency. But if the debt collector has proof and gives it to you, then the collection process can continue.

Evaluate your financial situation

If the pay-for-deletion letter you submitted is accepted, you will typically have limited time to make the payment. You should only send one if you are confident that you will be able to provide the amount that was agreed upon.

Keep records of the letter and payments

Keep a copy of the letter for yourself before sending it out. After the other party has accepted your terms, you can send the money along with a copy of the agreement and keep a copy for yourself. Also, if possible, use a delivery confirmation system like "return receipt" or registered mail. You'll be glad you took these precautions if there are any complications.

What if the debt collection agency rejects your pay-for-deletion offer?

There is no assurance that your creditors will approve the pay-for-delete offer. Offering to accept payment in exchange for deletion is merely a request. You can try the following options if your offer is not accepted:

- Repay the full amount you owe regardless; having no outstanding balance is preferable to having a balance that is not paid in full.

- You can settle the debts for a lump sum payment of money that is less than the total amount you owe; however, you will first need to make an offer to settle the debt and have the creditors or collectors accept it.

- Make a new pay-for-delete or a settlement offer once the account has been transferred to a new collector, which typically occurs every six months but can occur less frequently.

- Accounts that go to collections are removed from your credit report seven years after the first late payment. Credit scores take an initial hit from new accounts, but the damage does lessen over time. Leaving the accounts on your credit report and waiting until they disappear on their own is an option. You can opt for this if you aren't planning to apply for a mortgage or any other new credit in the near future. Be aware that you may be sued for the debt and that collection efforts will proceed (you can stop calls from a third-party collector with a cease and desist letter).

Is it a good idea to use pay-for-delete?

As a rule, consumers shouldn't use pay-for-deletion to deal with a collection account that shows up on their credit reports. To help you see why pay-for-delete is not the best option for raising your credit score, consider the following:

Credit bureaus do not recommend it

The strategy is not explicitly legal or illegal, but it does exist in a gray area because of the Fair Credit Reporting Act. This is because only incomplete or incorrect records can be removed from a consumer's credit report, not fully repaid accounts. Therefore, pay-for-delete letters are usually not binding in court.

The debt collectors may not remove the delinquent account

A debt collection company typically only cares about getting paid. This is why most creditors and debt collection agencies will accept payment but keep the account listed on your credit report even after you've requested that it be removed.

The account will not be deleted entirely from your credit report

A credit bureau can correct errors and report payoffs, but they are unlikely to delete an entire collections account. This is because a collector cannot resolve inaccurate information provided by the original creditor.

Pay-for-deletion may not improve your credit score

Every credit score model handles collection accounts slightly differently, and some models, like the FICO Score 9 and VantageScore 3.0, completely ignore them.

Bottom line

Pay-for-delete letters can be a helpful tool to eliminate debt and remove negative remarks from your credit report when settling your debt. However, the letter is not legally binding. Partially due to the latest credit scoring models, pay-for-delete offers have decreased. This is primarily because these credit scoring models do not consider paid accounts when calculating a score.

Moreover, credit reporting agencies discourage pay-to-delete initiatives and instead recommend that only incorrect information be removed from files.

But if you're in a better financial position now and know that collections activity will hurt your credit, a pay-for-delete letter might be an excellent way to try credit repair.

Suppose you are still unsure what to do after sending a pay-for-delete letter and rejecting it. In that case, you should arm yourself with some financial resources and seek a professional's help to understand your credit situation better.

Updated on: December 20, 2022