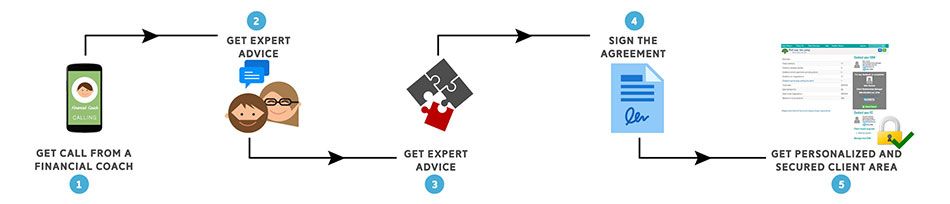

What to Expect When You Choose OVLG for Debt Relief

Step 1: Consultation with Attorney Solomon's Assistant

When you request a free consultation, you'll receive a call from Attorney Solomon's experienced assistant. To ensure you receive the most appropriate advice, please gather the following documents:

- Your most recent pay stub (last 6 months if you receive irregular bonuses or overtime)

- Credit card statements

- Bank statements

- A comprehensive list of your debts

If you're experiencing any of these warning signs, don't hesitate to seek help:

- Consistently missing credit card payments

- Frequent debt collection calls

- Financial stress and frustration

- Lack of a budget plan

- Living beyond your means

- Sleepless nights due to debt worries

- Impulsive spending habits

- Hiding debts from your spouse

- Low credit score

Step 2: Personalized Debt Counseling

During your consultation, Attorney Solomon's assistant will ask targeted questions to fully understand your financial situation, such as:

- How you currently manage your debts

- Recent missed payments

- Debt collection calls received

- Ability to cover living expenses

- Loan application rejections

- Reliance on credit cards for everyday costs

Based on your responses, our team will:

- Accurately evaluate your financial standing

- Calculate your income, expenses, and savings

- Provide a complimentary budget counseling session

- Offer personalized debt advice

- Share tips for living frugally while repaying creditors

- Develop an affordable monthly budget plan

- Explore debt relief options that protect your assets

- Suggest legal debt relief programs (debt settlement, debt management, debt consolidation, or bankruptcy)

Remember, you are under no obligation to follow our suggestions and may stop the counseling at any time.

Step 3: Understanding Your Debt Relief Program

If you choose to move forward with a recommended program, Attorney Solomon's assistant will provide a detailed explanation of the associated costs and steps. OVLG offers four primary debt relief programs:

- Reduces your total payoff amount

- Combines multiple bills into a single, manageable repayment plan

- Lowers interest rates on unsecured debts

- Discharges debts in 3-4 months through asset liquidation

Debt counseling is provided free of charge. If you enroll in our debt settlement program, we charge a nominal fee to facilitate your repayments.

Step 4: Signing the Agreement

Upon deciding to work with OVLG, you'll receive an electronic copy of our agreement. A dedicated Client Relationship Analyst (CRA) will be assigned to your account and will collaborate with you on your monthly budget.

Before signing the contract, ensure that:

- You fully understand the terms and conditions

- There are no hidden fees

- The program's duration is clearly specified

Step 5: Access to Your Secure Client Area

To maintain transparency, you'll gain access to a secure client account where you can view:

- Real-time performance reporting and case updates

- Current status of important documents (Representation Agreement, Limited POA, Settlement Letter, etc.)

- Detailed budget analysis

- Complete transaction details and payment information

- Overview of your debts and creditors, including settled accounts, ongoing payments, and negotiations

- Your total debt and trust account balance

- Instructions for creating and tracking support requests

At OVLG, we're committed to providing personalized, compassionate, and transparent debt relief services. Our team is here to guide you toward financial freedom.

Updated on: