Debt repayments may seem like a redundant task. The moment you’re about to pay off your debts completely, you incur fresh ones due to some unplanned expenses. The reason could either be your impulsive purchases or an emergency, but the fact remains that you’re never out of the vicious cycle of debt.

You’re trapped in a debt wheel, which seems unbreakable.

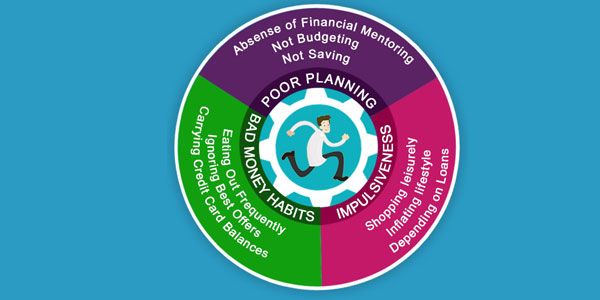

Here’s a graphic display of - What’s keeping you trapped in debt?

Though your financial scenario could be similar to many others, yet it’s you who’ll have to decide the do-it-yourself debt relief strategy. So, if you’re seeking to break-free from your invincible debt cycle, then you may have a look at what all has been said about how to pay off debts once and for all.

Secret #1 – Debt repayment is a habit. Not an event.

Paying off debt may seem like winning a marathon. Mostly, because you’ve repaid one of your creditors in full. This victory may make you feel entitled to go steady and take things in a more relaxed way.

But, ask any professional marathon runner worthy of his mettle, and you’ll be happy to learn that nobody hangs up his boots, once a race is over. He continues to train himself for future challenges. The fact is, if he stopped training post a competition, then he’d never be able to hit the racetrack again.

It’s every marathon runner’s mindset that won’t allow them to sit back and do nothing, as racing has become an integral part of their lives. The same holds true in case of getting out of debt. Remember, debt repayments aren’t one-of-its-kind event. Focus on developing your financial wisdom and make money work for you, instead of being a slave to your financial impulses.

Similar to a trained marathon runner, you need to change your mentality. Once your mentality, your attitude, has changed for the better, you’d come out of the choppy waters of money management successfully. You can make things possible, only if you want to and are willing to work by the norms.

Secret #2 – Raise emergency fund. Break debt cycle.

All your committed debt repayments will be futile, if your plan does not plug the loopholes. To become successful, you need an emergency fund. Amazed! You may inquire, “How do I raise an emergency fund after making the debt repayments?”

The idea here is to create a financial cushion that will help you to absorb immediate financial shocks and bounce back financially stable. The whole process of creating a financial cushion is a time-consuming one and, as Rome wasn’t built in a day, so will be your emergency fund.

You’ll have to contribute a certain percentage of your monthly paycheck towards your emergency fund, raising the bar eventually. For example, you start with contributing $500 to your emergency fund, then increase it to $1000, and higher, thereby saving at least 3-6 months of your present living costs.

The bigger your emergency fund, the better equipped you’ll be financially, to stave off emergency costs. And, emergencies do happen.

Creating an emergency fund will provide you with two advantages. They are:

- Credit card balance is dangerous - When you start raising an emergency fund, you’ll realize how crucial it is to keep your credit card outstanding balance from spiraling beyond your control. The plastic won’t safeguard you from financial disasters. Rather, if you continue swiping your cards at the slightest pretext, then you’ll fall back into the debt trap repeatedly.

- Saving is healthy - Contributing towards your savings account will help you to develop a much needed mentality, i.e., to cut corners and save money. The moment you start saving money, you’ll know the reality of what a true emergency means and what’s not. A financial cushion will make you independent of your credit cards to rescue you from emergencies.

Basically, with a good emergency fund, you’re setting yourself up for a foolproof financial success.

Secret #3 – Debt repayments matters the most. How you do it is secondary.

You can pay off debt, in more ways than one. Say, for instance, you can either opt for debt snowball, debt snowflake or debt avalanche to serve your debt relief purpose. No matter what method you choose, your debt repayments will mainly depend on your current financial situation.

For some people, debt avalanche has been a more profitable option, as it saved them a good amount of money, and to a certain extent they’re right.

But, here’s the catch - your debt repayment method is secondary in your list of priorities, what matters is your debt payments. Using mathematical calculation, you can arrive at a rational argument, but debt is mostly an emotional entity. So, it’s better to choose a debt relief plan that suits your temperament.

Spending hours, weighing pros and cons of each and every debt repayment method, and doubting your choice once you’ve made up your mind is a waste of your time, money and resources. Just make a debt repayment plan and stick to it.

Your commitments towards breaking the perpetual debt cycle will lay the foundation of a financially healthy future sans debt. Finally, your actions will score over the debt repayment method you choose, not the other way round.