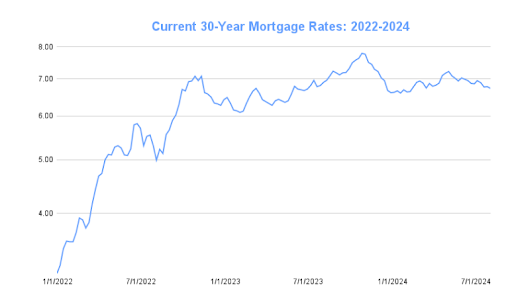

Are you exploring your home-buying options lately? The current mortgage rates are around 7%. The 30-year fixed-rate mortgage is 7.5 percent, and the 15-year fixed-rate mortgage is 6.7 percent. The refinance mortgage rates are around 6.7 percent.

We all know mortgage rates impact home-buying decisions. A high mortgage rate implies a high monthly payment. If you can’t make the required monthly payments, you can very well lose the home to foreclosure. Buying a home is indeed not an easy ordeal.

What is a Mortgage Rate?

A mortgage rate refers to the interest that is always paid on a house loan. It is displayed as an annual percentage, indicating the amount of interest one pays for money borrowed to purchase a house.

Your mortgage rate will determine how much of your money you are required to pay per month during your loan. Many things impact this rate. These include the type of loan you choose and how long you will pay it off. Your credit score also comes into play in determining this. So does the overall state of the economy in its relationship with the mortgage rates.

What Factors Affect Mortgage Rates in the Housing Market

There are a number of influential factors on mortgage rates that influence the general market and each individual borrower. Knowing these drivers is helpful in helping would-be homebuyers navigate the deep waters of home financing.

Credit Score

Your credit score is a huge determinant of your mortgage rate. The better your score, the lower your rate is likely to be. All lenders are looking for one thing in consumers: borrowers that they can depend on to get their money back. Your credit score arguably is the largest determining factor of this. If you have a worse score, you'll have fewer lending options and pay higher interest rates. A FICO score of 670 or above is considered good.

Loan-to-Value Ratio

The LTV ratio is the percentage of your loan amount compared to the price of the property. Generally, a reduced LTV ratio equates to a reduced mortgage rate. Your down payment will determine the LTV ratio; the greater your down payment, the lesser the LTV ratio and the less risk for the lender. For example, a 20% down payment equals an 80% LTV ratio.

Debt-to-Income Ratio

Your DTI ratio is the total of all your monthly debt payments divided by your gross monthly income. The lower, the better it is regarding showing how well you can manage debt and handle the loan. Most of the time, a higher DTI ratio translates to higher interest rates. Most conventional loans require a DTI of 45 percent or less. Some lenders might go up to 50 percent if you have other good qualities, such as a lot of savings. For the best rates, aim to have a DTI of 36 percent or less.

Loan Amount

A larger loan might see a lower rate if you have the ability to make a large down payment and your DTI is low. However, you'll probably end up with a higher rate if you're really stretching your funds.

Closing Costs

These can also raise your rate. For example, a lender might charge you a slightly higher rate if you want to roll these costs into the loan instead of paying them upfront.

Discount Points

These are optional extra fees that are paid at closing in exchange for a lower mortgage rate. They're essentially prepaid interest.

Property Type in the Housing Market

Property Type

The type of property you are buying can impact your mortgage rate. Here's what you need to know:

- Primary residences usually get the best rates

- Second homes and investment properties usually have higher rates

- Condos, manufactured homes, and multi-unit buildings often have higher rates than single-family homes

Economic Factors

The general economy has a profound effect on mortgage rates.

Some of the major factors are:

- Overall Health of Economy: In a good economy with excellent growth and job creation, mortgage rates are normally higher, while in economic downturns, they are lower.

- Inflation: An increasing rate of inflation is followed by increasing mortgage rates since the lenders charge more to maintain earnings margins in the view of decreasing purchasing power.

- Federal Reserve Policies: Even though the Fed does not directly control mortgage rates, it does have a lot of influence. With respect to this, when the Fed increases interest rates, generally speaking, it forces mortgage rates higher; when it lowers them, it tends to drive mortgage rates down.

Brief history of mortgage rate trends over recent decades

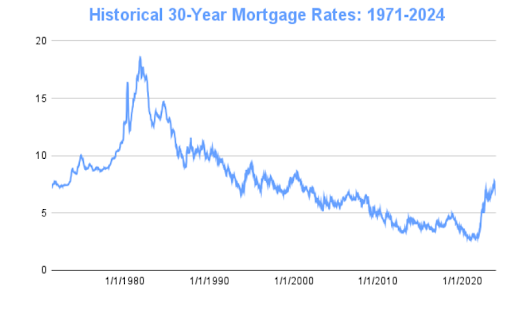

Freddie Mac is the main Statistical source in the industry, and it started compiling statistics in 1971. Since April 1971, the average for a 30-year fixed-rate mortgage is 7.74% through July 2024.

Source: themortgagereports.com

Source: themortgagereports.com

Mortgage Rate Projections for 2024.

Any homebuyer or homeowner considering refinancing will want to understand the possible trends of mortgage rates as a precautionary measure. Though predictions may vary, checking the forecasts from multiple experts provides a clearer picture of what one might expect in the new year.

Analysts indicate that market conditions are going to knock on the average 30-year fixed-rate mortgage in Q3 2024. Some of the key points include:

Projected Mortgage Rates Are Expected to Rise, which Will, Accordingly, Impact Month-to-Month Payments and, Consequently, the Affordability of Housing.

Home loan rates may drop to 6 percent in 2025 but aren't likely to reach 3-4 percent. First-time homebuyers shouldn't get too hopeful.

Expert Predictions:

Freddie Mac:

- Rates will likely be higher for most of 2024.

- Predicting rates higher than 6.5% for the rest of the year.

- Modest and steady drop in the second half.

Fannie Mae:

- Averaging 6.8% through Q3 2024.

- Averaging 6.7% in 2025.

National Association of Realtors :

- Expects Q3 rates to average 6.9%.

- Revised their Q4 forecast from 6.5% to 6.7% by the end of 2024.

- Predicts lower rates, higher home sales, and stabilized price growth in the second half of 2024.

Mortgage Bankers Association:

- Expect rates to dip as low as 6.8% in Q3.

- Predicts a rate of 6.6% by the end of 2024.

- Anticipating two more Fed rate cuts before year's end.

Bank of America:

- Anticipates the first rate cut in December.

- It recognizes the disappointment of housing advocates who were gunning for sub-7% rates.

How a High Mortgage Rate Affects Purchasing a House

Decreased Affordability

With increased rates, the affordability of the housing market decreases, which usually has a tremendous impact on most individuals, particularly first-time buyers and those earning low incomes.

- New home buyers would slow down because of the higher monthly mortgage payments, hence rethinking their housing options.

- This gives them cold feet to buy a house, thereby changing the dynamics of the housing markets.

- For this, policymakers often work with financial advisors on the contours of economic policies and personal financial planning strategies that make homes more affordable.

Declines in Sales

Raised mortgage rates create some intricate dynamics for home sales, affecting buyer behavior in both ways.

- Some buyers may hurry to buy before rates rise further; others may become hesitant or are priced out of the market.

- Overall sales are affected by the quantum of interest rate hikes, general economic conditions, and personal financial positions.

- A potential drop in home sales will then affect inventory levels that may further drive home price trends as well as sentiment in the housing market.

Stabilization of Home Prices

Higher interest rates can lead to property value stabilization, which is oftentimes seen as a positive trend in the real estate market.

- A rising interest rate affects the supply-demand equation of the housing market.

- To an overheated market, this change will at least slow it down by cutting back the buyer competition and closing up the gap between supply and demand.

- Because of this effect, home prices can appreciate more slowly, which may improve affordability in the long term and bring about a healthier market regarding buyers and sellers.

Strategies for Managing Higher Mortgage Rates

Large Down Payment

The more money you can put down upfront, the better your terms of mortgage will be and the lower your monthly payments.

- The minimum down payment is as low as 3% or even 0% for some types of loans.

- Smaller down payments largely pave the way to higher interest rates since there is more risk associated with lenders.

- A 20% down payment for a conventional mortgage may nail a lower interest rate with no Private Mortgage Insurance required.

Research Government-Insured Mortgages

These loans, which are guaranteed by the federal government, are often easier on the pocket.

- Government-sponsored programs are usually more forgiving in their average interest rates.

- They may have more lenient credit score requirements and other perks for low- and moderate-income buyers.

- The fee structures for FHA, VA, and USDA can be very different, so it's a good idea to compare using a professional.

Consider an Assumable Mortgage

You can save money by taking over the seller's existing mortgage.

- This option will let you take over the seller's low-interest loan, which might save you thousands every year.

- Most of the assumable mortgages are government-insured loans, like VA, FHA, or USDA loans.

- You'll have to qualify for such loans.

Improve Your Credit

Boosting your creditworthiness can get you better terms on the mortgage.

- A credit score of 620 or above is normally satisfactory for conventional loans.

- The target is to hit the mid-700s to upper-700s so that the borrower can get the lowest possible interest rates. Even slight increases in your credit score can help with your interest rate.

Patiently Wait

Because mortgage interest rates go up and down over time, timing may be everything.

- While rates may balloon in an instant, they will also go down in due time. It is sometimes better to just wait and monitor them until they become more reasonable.

- Keep an eye on current rates to know when to start saving for a down payment or improving your credit.

Buy a Less Expensive Home

You may need to adjust your housing budget to accommodate higher rates.

- High interest rates might have already hit your housing budget.

- Further tightening your budget can help avert the danger of being "house poor" and leave room for other financial goals.

- This way, you'll be able to start with a less costly home, save for your dream home, and at the same time, be assured that the monthly payments will be within your reach.

Conclusion

Mortgage rates are shaped by economic forces and market conditions. While borrowers can't control these factors, they can improve their financial health to secure better rates. By maintaining good credit, saving for larger down payments and staying informed, homebuyers can navigate high-rate environments more effectively. Ultimately, a strong financial profile is the best tool for achieving affordable homeownership in any market condition.