As time gets harder and tougher for the US debtors, an increasingly large number of debtors are turning to credit card debt settlement as the best way to put an end to their financial trouble. When the debtors pull out their finances and see that it is impossible for them to repay the entire amount with efforts of their own, they usually consider debt settlement option to get rid of their debts. As a large portion of the outstanding balance is waived off by the creditors, the debtors find it easier to repay the remaining portion with the meager income that they earn. However, hiring a debt settlement attorney may often help you stay on an edge and complete the entire debt settlement process successfully. Have a look at the benefits that you may reap if you have an attorney by your side.

How can you get debt relief with the help of a debt settlement attorney?

When it comes to debt relief, you can take advantage of the option of debt settlement. You should know that debt settlement in the USA is regulated by both federal laws and state laws. In the US, debt settlement is a legal process by which you are able to negotiate and reduce your balances with various creditors. What you should know about the legal process is that it needs a lot of detailing and negotiations, which is not possible for you to do. Thus US debt settlement attorneys do this work for you. You should keep in mind that you can only settle unsecured debts like credit card debts and medical bills. If you have secured debts such as a mortgage or car loan, it won’t be possible to pay these back with the debt settlement process.

What a debt settlement attorney does for you to settle your debt?

It has been seen that a debt settlement attorney in the US can get your balances reduced by a good percentage.

Thus you can see how you can get out of your debt with the help of US debt settlement attorneys.

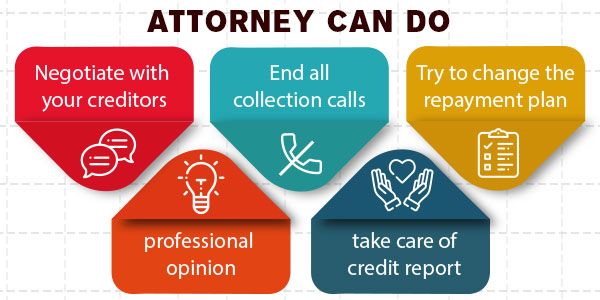

Here are some other benefits you can get from a debt settlement attorney.

1. Negotiates with your creditors

Unless you have professional debt settlement attorneys by your side, it is pretty tough to negotiate with your creditors to reduce a portion of the outstanding balance that you owe your creditors. As they have enough skill in negotiating with creditors, they can help you with a reduced balance so that repayment becomes easier for you.

2. Ends all collection calls

It is often seen that though a debtor enrolls with a debt settlement company, the debt collectors keep on calling the debotor. But when you have an attorney by your side, he will ask the collectors to stop calling you and inform them about the present status of the accounts that you owe.

3. Attempts to change the repayment plan

Once a portion of your balance is forgiven by the creditors, the debtor can either pay back the remaining amount in a lump sum or start making monthly payments that are within his means. This entire task is done by the attorney as he is a better negotiator and it is most likely that the creditors will agree when the lawyer asks them to change the repayment plan.

4. Has a professional opinion about things

When you’re a debtor, you may not be educated enough about the pros and cons of settling your credit card debt. But if you have an attorney, you can easily get professional advice about the steps that you need to take to repay your debts with ease as well as boost your credit score.

5. Your credit report is taken care of

When you settle your debts, it has a negative impact on your credit score, but if you can negotiate this with your creditor, this can be reported as “paid in full” to the credit bureaus. Instead of you, if your attorney speaks on your behalf, this will be beneficial to you. The biggest panic that debtors have faced while opting for debt settlement is the impact on the credit score. Yes, debt settlement does hurt your score but if you can take effective credit repair steps, you can certainly improve it in the long run.

Lastly, most Americans are in debt. If you are one of them who has incurred debt, then you can take help from the debt relief options available in the US. Debt consolidation and debt settlement are the two most popular ways of getting out of deb. You can consolidate your debts on your own. But, debt settlement is a complicated and difficult matter. It is almost not possible for someone to achieve debt settlement without proper training and experience. To get the best results, you should get professional help to assist you regarding your debt settlement situation. Debt settlement attorneys can help you out in such situations. Good luck!