According to a new study, at least a quarter of the roughly 8.7 million student loan defaults during the Obama administration and before is because of the housing crisis.

The housing collapse during the Great recession that survived from 2007 to 2010 was directly responsible for at least one-fourth increase in student loan defaults, according to the new study by the National Bureau of Economic research (NBER) that examined the implications of the then labor market shocks for the dramatic rise in student loan defaults.

While many reports have advocated against the non-traditional borrowers and blamed them for the rise in defaults, Holger Mueller and Constantine Yannelis, economists from the New York University argued against it, and said that the recession and the housing collapse was highly salient in nature and that’s why some areas saw bigger rates of defaults than others.

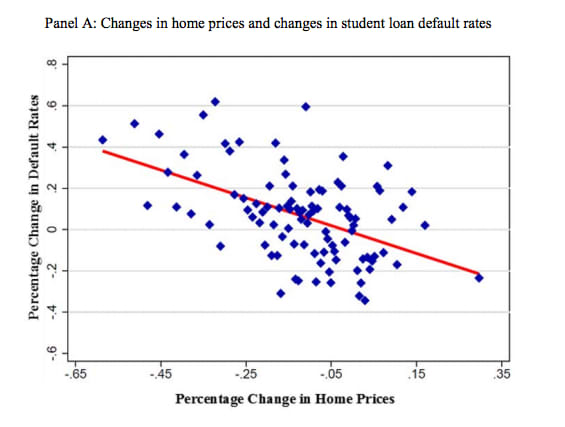

“The drop in home prices during the Great Recession accounts for approximately 24 to 32 percent of the increase in student loan defaults,” the authors estimate.

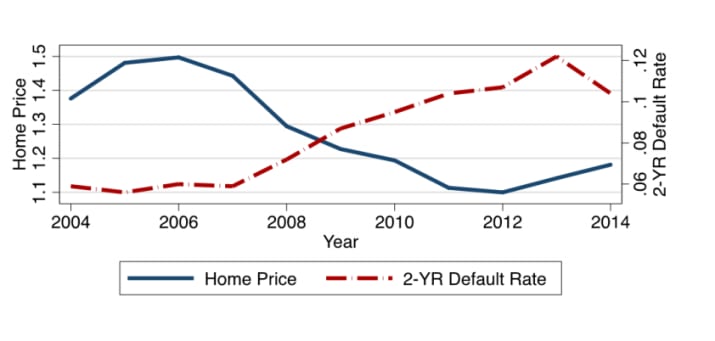

Though a million borrowers were randomly selected over time for the sake of the research, the researchers found a deep connection between home prices and student loan defaults on the zip code level. Even a 1% decrease in home prices in these areas saw an increase in defaults. They zip codes they worked with saw a 14.4% drop in home prices between 2006 and 2009, while new student loan defaults surged to 19% between 2007and 2010.

Drop in home prices starting from 2007 helped tank the economy; the labor market struggled in the zip codes where home prices faced the greatest heat; borrowers in those areas defaulted on their student loans more.

NBER / Via papers.nber.org

The authors found a strong relationship between home prices, employment losses, and student loan defaults at the individual borrower level, which is concentrated among low-income jobs.

The authors, after comparing the default trends of homeowners and renters, found no evidence of a direct liquidity effect of home prices on student loan defaults. According to them, those who were most likely to default were low-income borrowers having high amounts of outstanding debt.

Lastly, the authors tried to show that the Income Based Repayment (IBR) program introduced by the federal government in the wake of the Great Recession reduced both student loan defaults and their sensitivity to home price fluctuations.

After the introduction of IBR in 2009, many were eligible for relief. It allowed the borrowers to pay off student loans based on their actual income, with a 15% cap on payments as a portion of income. The program really helped low-income borrowers who would otherwise default if faced prolonged unemployment.