What kind of life do you want to lead?

A life of peace and tranquility or a life full of stress and debt?

Your choice in the 20s makes all the difference. It determines your future and retirement life. You build your career in your 20s. You build your most important relationships in this stage. You march ahead toward your financial goals.

The habits one builds up can either make or break their life. Good financial habits help in achieving financial freedom. On the other hand, bad financial habits can push one toward stress and debt.

Avoiding financial risk in your 20s isn’t about restricting your life or giving up enjoyment; it’s about making smart choices to protect your future.

Here’s how to avoid the common financial risks and build wealth in your 20s.

1. Know Where Your Money Goes

Before building wealth, one must understand where his or her money is going.

Track Your Income and Expenses: Use a simple Google spreadsheet or a budgeting application to track every dollar that comes in and every dollar that goes out for one month. You will likely be surprised at where your money is going.

Practice Smart Financial Behavior: When you record your expenses, you can make a budget (or spending plan). This is not a financial prison but rather it's a tool that will help you to spend smart. By understanding where every dollar should go, whether towards rent, savings, groceries, or entertainment, you take ownership of your money by eliminating pointless spending.

2. Building Your Financial Shield

Life is unpredictable. A financial "shield" protects you from unexpected life events.

Build an Emergency Fund: Set aside money to cover 3 to 6 months of essential living expenses in a liquid savings account. This fund is not for vacations or down payments. It's for true emergencies: a job loss, a medical crisis, or an urgent car repair.

Get Adequate Insurance Coverage: Insurance is a financial umbrella. You pay a small premium to protect yourself from an unpredictable financial loss. In your 20s, these are crucial.

Health Insurance: One hospital visit can put you in financial ruin. On a parent's plan, an employer's plan, or a marketplace plan, do not go without it.

Renter's Insurance: If you rent, get it as soon as possible. It is very cheap (usually $10-$20 a month) and it protects all your belongings in case of theft or disaster.

Auto insurance: While this is legally required if you own a car, make sure your coverage is sufficient for you.

3. Pay Off Your Debts

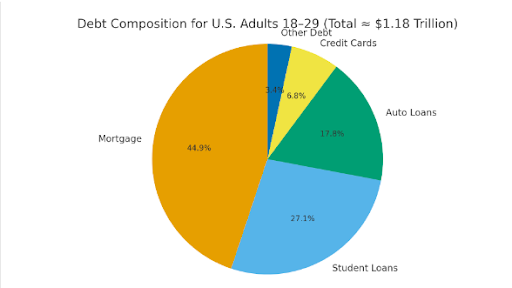

For most young adults, debt is the single largest financial risk.

Pay Off Your Student Loans:

Student loans are a reality for millions. The risk here is letting them linger for decades, accumulating interest and preventing you from saving or investing. Create a plan. Understand your loan types, interest rates and repayment options. Pay more than the minimum if it’s affordable, to speed up the payoff.

Avoid Credit Card Debt:

This is the most dangerous type of debt. Credit card interest rates are phenomenally high, compounded daily and create a financial trap nearly impossible to escape. Treat your credit card like a debit card: if you cannot pay it off at the end of the month in full, do not buy anything.

If you do get into credit card debt problems, consider the following debt relief options:

Build Credit Responsibly: This may sound counterintuitive, but you have to build a good credit history. You will need a good score to rent an apartment, get a fair auto loan, or one day buy a home. The safest way to do this is to get a credit card, use it for one or two small, planned purchases like gas or a subscription and then set up an automatic payment to pay the bill in full every single month.

4. Plan for Your Future

Your financial decisions are no longer just about you, especially when building a life and perhaps a partnership.

Establish short and long-term goals:

Money is a tool to build the life you want. What is that life? Your goals give your budget a purpose.

Short-run goals include holidays, a new laptop, moving into a new apartment within 1 to 3 years.

Long-term Goals (5+ years):

A down payment on a home, starting a business, and yes, retirement. Start investing for retirement now, even if it's just a small amount. The power of compound interest is a force you can't get back.

Discuss Finances with Your Partner:

Money is among the top reasons couples break up and get divorced. The financial risk of not talking about money is immense, so you have to be open and frank about your debts, income, expenditure, and goals. You don’t have to agree on everything but you must have a shared plan.

Have a Budget-Friendly Wedding:

It's a big financial risk to start your marriage with tens of thousands of dollars in high-interest consumer debt. A wedding is one day; but marriage is a long . Prioritize your shared financial future over a single-day party. Set a budget you can actually afford and stick to it.

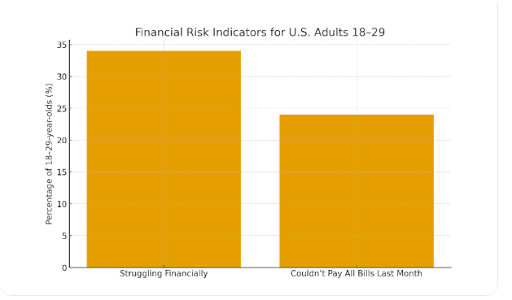

How many US adults are in financial risk?

- United States Population by Age - 2025 Update

- Student Loan Debt vs Credit Card & Mortgage Debt (Compared) | 2025

- Federal Reserve Board Publication

- Average American Debt : Household Debt Statistics

- Generation Z Credit Scores and Debt Rise

- Gen Z Is Drowning in Debt, and They're Blaming the Trump Tariffs-Here's Why

- Gen Z's credit scores are dropping. Here's what to do if yours is too

- 5 facts about student loans

- federalreserve.gov

- The Fed - Higher Education and Student Loans

Conclusion

The biggest financial advantage you have in your 20s is time. If you start investing now, even small amounts, it will grow gradually and turn into a huge fund. Thanks to something called compounding interest. So, start investing now after saving a significant amount in your emergency fund.