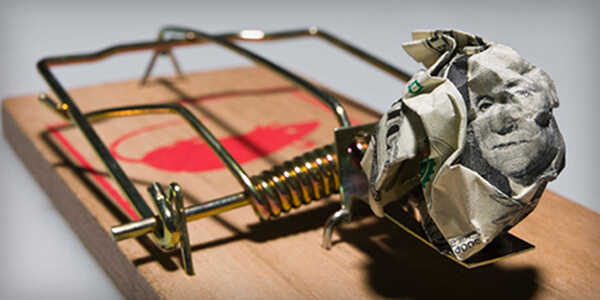

If you’ve accumulated a large amount on your multiple credit cards and have chosen to consolidate your debts, then you need to be extra careful. There are a number of debt consolidation companies appearing at every corner of the street, claiming as a good service provider. It’s not that all such companies are scams, but you should be aware of every consolidation mistakes to avoid financial hassles in the long run.

7 Debt consolidation mistakes to avoid

Below are some most common consolidation mistakes you should avoid while combining your debts to become debt free.

1. Not consolidating all high interest debts

You shouldn’t consolidate all your credit card loans into a single card in a balance transfer method. If you just transfer the balances of few cards with a high interest rate into another card with a low interest rate, while leaving out some other cards, then you will face a lot of complications. You’ll have to pay for the consolidated cards, or else, you also have to go on paying for the ones which you haven’t.

2. Not evaluating credit reports

Before applying for a credit consolidation loan, you need to check your credit reports properly. Too many debts or errors in your credit report will make it difficult for you to take out a loan. Hence, you should check your credit report thoroughly and contact the credit reporting agencies immediately in case of any discrepancies.

Read more: Credit card consolidation - Dump high interests and pay one bill

3. Not verifying the company

Don’t just rely on any credit consolidation company that comes your way. You should check the legitimacy and the records of the company from different sources before approaching it, in order to avoid scams companies. Also, you should check a few companies and what kind of terms they are offering before signing.

Read more: How to spot and avoid debt consolidation scams

4. Not shopping around

Make sure you do a comprehensive market research to grab the best loans in the market. You need to compare the various loans and their rates, or else it’ll become quite impossible for you to know which rates will suit your financial affordability and which rates will offer you the most benefit.

5. Closing down all accounts together

Try not to close down all your accounts with zero balance after transferring all your balances in one account. If you close down all the accounts together except one, then your credit limit may lower drastically and it’ll affect your credit score negatively.

6. Choosing the wrong option

Make sure you choose the right option in accordance with your financial affordability and budget. Know the pros and cons of each option so that you don’t face any trouble after you’ve already made the decision.

7. Not considering the costs of consolidation

Many options like, debt consolidation loans, home equity loans, balance transfer cards are there to consolidate your debts. But before considering any particular decision, you must check the costs that are involved in the process so that you don’t end up spending more money.

Read more: Say NO to debt consolidation loan and other balance transfer methods

Final words

Along with avoiding the above mistakes, you should start spending judiciously. You should plan a budget and save considerable amount of money each month in order to pay the monthly bills on time. Remember, even a small mistake can cost you dearly in the long run and this may ruin your personal finances as well. So, be very careful while considering consolidation as your debt pay off option.

Don’t miss - 5 Mistakes which can prolong the debt consolidation process