Answer a few questions in a minute and we will tell you about the debt relief program that is best suitable for your

current financial scenario. Remember, the right debt relief program will help you reduce your existing problems and

make your financial life better. On the other hand, wrong debt relief program will only complicate your life.

Do you want to get rid of late fees?

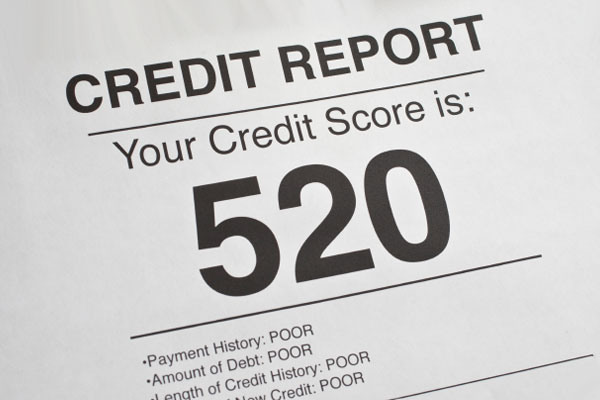

Late fees: This is the extra fee you need to pay for not paying a bill on time. Late fees affect your

credit score badly. They stay on your credit report for 7 years.

Do you want to pay off debts legally?

It is always best to pay off debts legally since you'd have less hassles later. You'll have proper

documents and creditors won't be able to harass you for further payments.

Do you want to reduce the number of collection calls?

A huge number of collection calls make your life hell. Usually, you get collection calls when you

haven't paid bills for a long period of time.

Do you want to make single monthly payments?

Single monthly payments are better when you're unable to manage multiple bills. You get a chance to

pay only one bill instead of 8. There are less chances of forgetting the payment date.

Do you want to get budget counseling without paying a dime?

Budget counseling teaches you money management skills, tips to avoid making financial mistakes, and

reduce your debt problems. You can get right financial advice to improve your credit life.

Do you have plans to apply for loans in the next 6 months?

Think and decide the type of loan you want to apply for. Creditors will check your credit thoroughly,

be it a secured loan or unsecured one. Bad credit will make it tough for you to obtain a loan. You

may need to get help from a co-signer to obtain loans.

Do you want to lower your interest rates?

Lower interest rates can help to simplify your payments. You may have to shell out less dollars from

your wallet. This will help to accelerate your debt recovery and saving process. You can save

some dollars for rainy days.

Do you want to raise your score?

A good credit score will always help you get a line of credit at favorable rates. The better your

score, the better your financial future. Not every debt relief program will help to raise your

credit score. So, think carefully.

Are you willing to compromise with your credit score a little bit and repay

debts?

Before answering this question, just remember, your credit score has already taken a hit by now.

Unpaid debts and late payments are already on your credit report and they're going to stay for 7

years at least. Once you pay off debts, you can finally work on rebuilding your credit gradually.

Is it ok with you if your credit score drops by 200 points?

Credit score determines your credit worthiness. A big drop in your score will lower your credit

worthiness. You're less likely to obtain loans at low interest rates. Some lenders may not be

willing to offer you a loan soon.

Do you want to reduce principal amount?

This is the actual amount you borrowed from the lender. It becomes easier to pay off debt when the

principal amount is reduced since you've to pay less amount. If your principal amount is slashed

from $25000 to $20000, then you'll save $5000.

Are you willing to save dollars in a trust account?

It is best to save money in a (trust account) FDIC insured bank. Once you deposit sufficient amount

in the trust account, the debt relief company will negotiate with creditors and settle debts

eventually. As per the FTC laws, you'll have access to the trust account. So, don't worry.

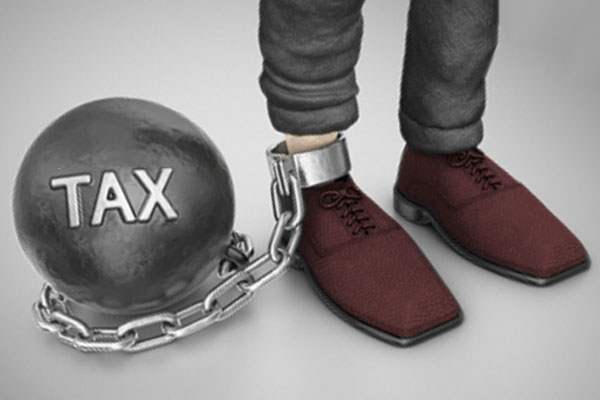

Do you have tax debts and wish to get rid of it?

Tax debts are really bad. If you want mental peace, then try to get rid of them fast. Usually, tax

debts remain on your credit report for 7 years. However, unpaid tax liens may stay on your credit

report for an indefinite period.

Do you have liens and want to remove it?

You can't even think of selling your property when a creditor has imposed a lien upon it. Even if you

sell your property, the creditor will be paid first from the sale proceeds. Suppose, a lien has been

imposed upon your home. If you owe $50,000 to creditors and you sell your home at $75,000, then

you'll get only $25000 in your hand. The remaining $50,000 will go to your creditor.

You're the best candidate for debt settlement

You're a fortunate guy. You can still recover from your financial problems. All you need to have is the right

strategy. Contact out financial coach for any kind of assistance.

Call us at

(800)-530-OVLG for any help.

Debt management (DMP) is the best option for you

Okay. Your credit score is really important for you. You want to pay off creditors through affordable

payments.What you need is budget counseling and single monthly payments. DMP can help you with that.

Call us at

(800)-530-OVLG for any help.

You're the best candidate for debt settlement

You're a fortunate guy. You can still recover from your financial problems. All you need to have is the right

strategy. Contact out financial coach for any kind of assistance.

Call us at

(800)-530-OVLG for any help.

Bankruptcy is the only solution for you

Sorry! Your financial situation is really very bad. Only bankruptcy can help you to get a fresh financial

start.

Call us at

(800)-530-OVLG for any help.

What is a debt relief program?

A debt relief program helps you pay back your creditors and attain financial freedom. These programs give you advice on dealing with multiple bills and create a repayment plan as per your

affordability.

Check out the 6 debt relief programs that can help you get rid of multiple bills.

- Credit counseling: It helps you repay multiple bills with money management techniques and

budgeting.

- Debt settlement: It helps you pay less than what you owe on your outstanding balance.

- Debt consolidation program: It helps you club your multiple bills into a single monthly payment

plan.

- Debt consolidation loan: It helps you pay off your debts with a new loan at a low-interest

rate.

- Debt management: It creates a smart repayment plan and helps you lower interest rates on your

existing debts.

- Bankruptcy: It helps you discharge your unsecured debts in 3-4 months. The court sells the

non-exempt assets and gives you the repayment plan.

How do debt relief programs work?

Debt relief programs work on 2 simple principles. Either they would cut down interest rates on your existing debts

(as it happens in debt consolidation

or debt management) or they would lower

your outstanding balance (as it happens in debt settlement). But the goal is same.

The goal of all types of debt relief programs is to help you save thousands of dollars within a short period of time.

Usually, a debt relief program gives you a date when you'll attain financial freedom. In Chapter 7 bankruptcy, you

can expect to get rid of debt in 3-4 months. In Chapter 13 bankruptcy, you'll need 3-5 years to pay off your debts.

Perhaps, the fastest way to relieve your debts is to enroll in a debt settlement program. This program can help you pay off your credit cards

in just 3-4 months. Of course, this depends on the amount of debt you have, the willingness of the creditor to

settle, and the negotiation skill of the debt negotiator. Otherwise, it may take between 2 years and 4 years to

knock off debts.

A debt management program or a debt consolidation program again stretches from 2 years to 5 years since you're paying

off the entire amount. Get the Step-by-step analysis of the debt relief

process

How do credit card debt relief programs affect your score?

Debt relief programs are designed to improve a person's overall financial health. They help people to fix their

serious financial issues and increase credit score gradually.

Usually, the impact of credit card debt relief programs over credit score depends on the following factors:

- Debtor's behavior or activities outside the debt relief program

- The type of debt relief program chosen

- The financial situation of the debtor before joining the credit card debt relief programs

Example:

Financial activities of the debtor

If an individual accumulates new debts, then his credit score will drop due to high debt-to-income ratio.

Type of credit card debt relief programs

If you choose bankruptcy, you're likely to lose more than 200 points straightway. However, if you choose settlement,

you're likely to lose only a few points.

The good news is once your debt is paid off, your debt-to-income ratio improves. This helps to increase your score.

Financial situation of the debtor

If your credit score was bad at the time of enrolling in a debt settlement program, then the effect on your credit

score would be minimal. However, there can be a big drop in your score if you had stellar credit before joining the

credit card debt relief program.