Statistics from the National Association of Federal Credit Unions strongly back the point that the credit unions are a much preferred choice over the banks. Membership for the credit unions have rose to around 95.2 million in the recent times which was 88.6 million earlier. Along with that the unions hold more than $1 trillion in assets.

Most of the growth has taken place after the US was hit with the recession in 2008. Credit unions gradually built their dependability as the banks, both the big and the community ones, backed out and stopped with their lending practices at a time when financial assistance was most needed.

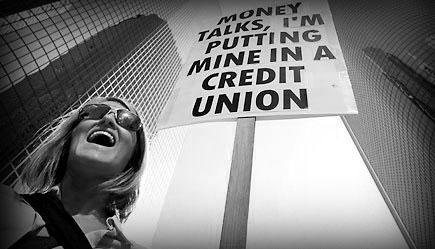

Even now, the unions appear to be a better choice as the banks have increased their fees and imposed restrictions on the number of free checking accounts. Recent surveys have revealed that 72 percent of the credit union checking accounts are free while it's only 39 percent for the banks. Dan Berger, president and CEO of the National Association of Federal Credit Unions (NAFCU) emphasizes that the credit unions try to develop a long-term relationship with the consumers this way, so that once a consumer becomes a member of a union, he or she stays with them for the rest of their lives.

However, this doesn't mean that the credit unions are allowed any special provisions or that they can dodge the regulatory arrangements. They withstand the same pressures that the banks have been going through, including the all-time low interest rates. Dan Berger (NAFCU) acknowledges that the credit unions are definitely facing financial squeeze due to the low interest rates, and the small ones with less than $50-100 million in assets are mostly taking the hit.

The banks are also pressurizing for removal of the tax-exempt status from the credit unions. In case that happens, then the unions would need to modify their practices to survive. Consequently, they'll lose the individuality they have been maintaining this long and presumably turn into another form of banks.

However, to cope with the reducing interest rates, many of the credit unions are emphasizing on the lending operations, and diversifying with mortgage loans, credit cards and car loans. The only bright side that Mr. Berger foresees is that the Federal Reserve will probably start to trim their quantitative easing, making the rates soar up bit by bit.