Managing your monthly household expenses can overwhelm you. But you’ve got to organize your finances, make life-altering decisions and follow a spending plan. Not every home-bred, self-styled finance guru can help you, as your conditions are unique.

So, here’s presenting you the new kid on the block - The 50-20-30 budgeting rule, to help you do just that, ‘budget’.

What does 50-20-30 budgeting rule mean?

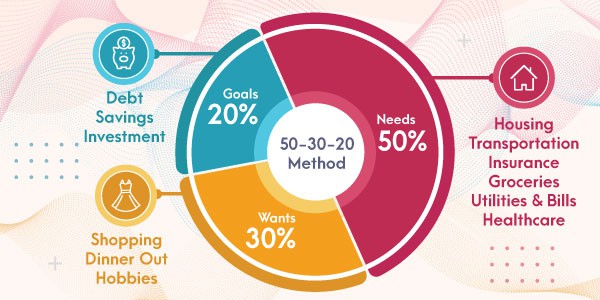

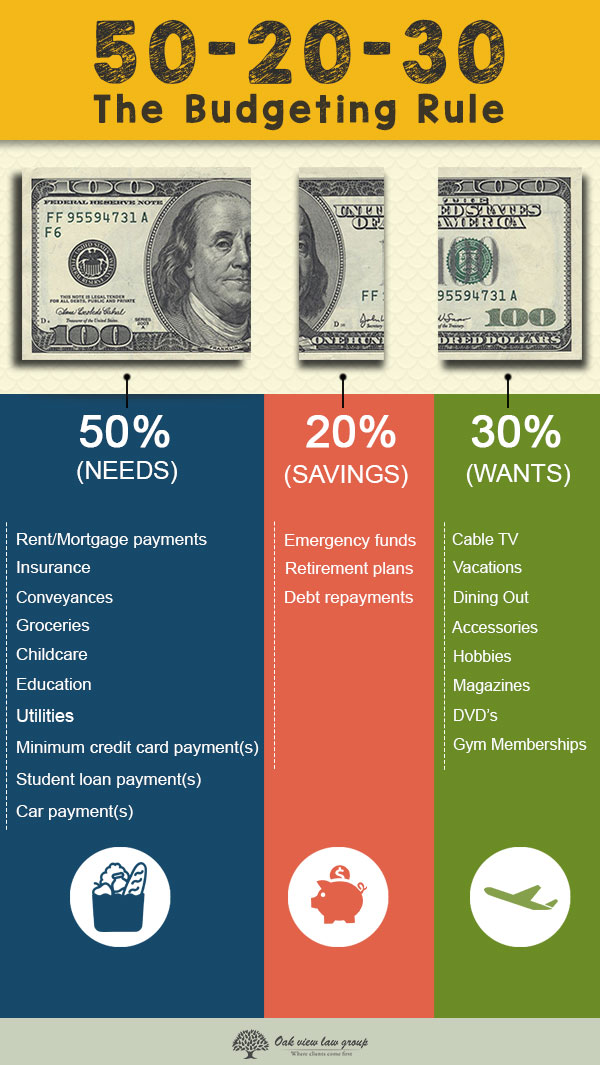

The 50-20-30 budgeting rule will help you divide your total income into 3 spending categories (as visualized in the infographic below):

Making of a 50-20-30 budget

You’ll have to get a clear picture of what’s happening with your money. Check your pay stub and calculate the exact amount of dollars you get in hand. Your in-hand cash will serve as the foundation for the 50-20-30 budget. In case you’re self-employed, take an average monthly income as your in-hand cash for the same.

Once you know how much disposable income you have with you, your next task would be to track your expenditures. Jot down everything you spend your dollars on, every dime of it should be written down to the last cent.

Adjust your income within these categories as already shown above. Cut off items that you don't need and stop wasting your hard-earned dollars unnecessarily.

Popularity of the 50-20-30 Rule

The 50-20-30 budget will simplify your personal finances. Your financial ship will do away with uncertainties. You’d be able to pay off your monthly bills, contribute towards your retirement/savings account, and even wriggle out a few dollars for self-indulgences.

You’ll stick to your budget without burning out months or years later. Hence, you’ll reach a remarkable level of financial stability.

Did the 50-20-30 budgeting rule help you or fail you? Share your story in the comments section below.