You know you’re in trouble when the bank calls you regarding a suspicious activity. Recently, my cousin sister got a call from the bank and was informed that her husband called for an online transaction. Apparently, he has forgotten the account password.

Beth (my cousin sister) immediately called up her husband and was informed that he didn’t make any call. But the damage was already done. When Beth called again half an hour later, the bank informed her that someone has withdrawn $4000 from the savings account. The imposter called again, talked to someone else in the bank and took away the money.

This was a shock. Someone has stolen Beth’s bank account information and wired the money. And this type of scam has spiked in the last few years.

What does the statistics say

- The account-transfer scam has increased by 31% from 2015 to 2016

- Consumers lost $2.3 billion, a figure which is 61% higher from the previous year (2015)

- Victims of account-transfer fraud pay $263, 5 times than the average figure

How bank account information is compromised or stolen

- Method of fraud: Malware, phishing, social engineering, email fraud, vishing smishing

- Point of fraud: online, mobile, bank employee, mobile, call center, customers,

- Method of wire initiation: bank wire system

What steps you can take to safeguard your funds

It’s high time consumers take safety precautions since banks, credit cards, debit cards and brokerage accounts are easy targets of the scammers. The chip technology on the plastics and the speed of electronic transfers in the banks make them an appealing target.

Thieves innovate new strategies to hack information of consumers. The latest in the block is the ransomware attack, another ploy of thieves to steal data and fetch money. You need to be vigilant to safeguard your confidential information and money. Otherwise, thieves can steal all you have and you can’t even do anything.

Here are the few steps you can take to safeguard your data and funds in your bank accounts.Be careful before sharing your account details:

Don’t update your account details in any budgeting application, online shopping portals, or any other third party. Find out why you need to update financial information and how to protect it.

Give a complex password:

Give a complex password so that thieves can’t crack it easily. Don’t use the same passwords in all the accounts.

Create a backup:

Create a backup of the information saved on your computer. Even if you become a victim of ransomware, thieves can’t blackmail you.

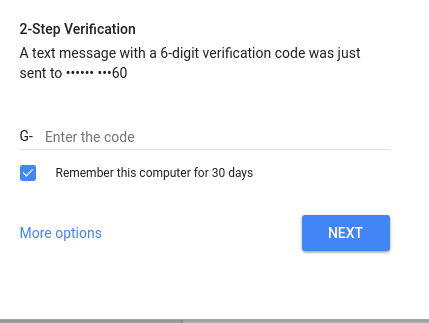

Opt for two-step authentication:

You must have seen this feature in gmail. When you opt for this feature, you can’t log in with just one password. You need to give secondary point of ID. This can be a texted code or just an email.

It is tough for the thief to get this texted code since it will be sent to your phone number.

Set up banking alerts:

Once you opt for this option, you’ll get an email alert or text when someone withdraws money from your bank account overseas. You’ll also get an alert when someone does an online transaction beyond particular limit or there is any account change.

Monitor your bank account every month. If you find any fraudulent activity, report it quickly. You may have to pay a penalty of $50, but several banks would even waive that.

Conclusion

In Beth’s case, it is suspected that her bank account information was stolen when she camped out a hospital for a few days. A little ignorance or neglect cost her $4000, which is a lot of money.