“Corporate Social Responsibility (CSR) in debt relief industry”!! Is it sounding like some unconceivable utopian concept that is too good to be true? Well, it might appear so, especially at an economic juncture when profit tops the priority list of most debt relief companies and CSR takes a mute back seat. Often the debt relief programs are found to contain no preventive measures against debt accumulation. And consumers enrolling for debt relief land up in more debts by the time the program ends. Things take an even worse turn when consumers fail to continue with the program owing to scarcity of funds, but nobody cares to offer them a fee refund.

So, the first step towards an authentic CSR can be taken in the form of a clear fee refund on the consumer's discontinuance with the program. Well, it is not a hypothetical resolution anymore but a practical precedent that OVLG has set by refunding one of their clients’ fees when the client decided to withdraw from her debt relief program with the company.

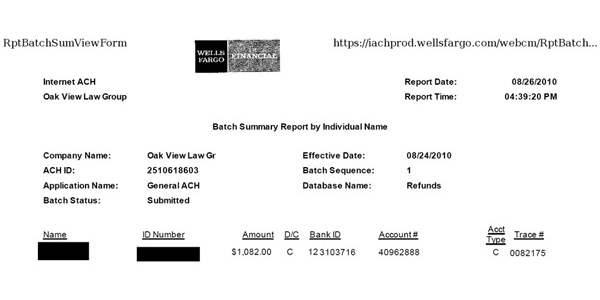

Mrs KW, who had enrolled with OVLG in 2009, decided to call off the debt settlement program she was in because of her financial hardship and ailing health in 2010. She requested for a partial refund of the fees she had paid to OVLG. But OVLG decided to repay the entire fee $1,082 that she had paid till then and extend its help to the distressed client.

Mrs KW, who had enrolled with OVLG in 2009, decided to call off the debt settlement program she was in because of her financial hardship and ailing health in 2010. She requested for a partial refund of the fees she had paid to OVLG. But OVLG decided to repay the entire fee $1,082 that she had paid till then and extend its help to the distressed client.

The act was a rare humanitarian approach in the history of debt relief industry where profit-making had been the usual mantra. OVLG, though its sincere attempt, has established that debt relief and CSR can transcend mercenary barriers. A client may not be able to continue with the debt relief program for several unavoidable reasons, but the company possibly cannot evade its responsibility towards the client. Refund of fees can actually help the troubled consumers cope with their financial hardship to some extent. Moreover a clear fee refund policy can be a genuine marker of the company's concern for its clients and thereby be a solid proof of the company’s corporate social responsibility to the society as a whole.

To know more about OVLG's refund of fees, click on the following link: https://www.prweb.com/releases/debt-relief/refund-policy/prweb4454204.html