COVID-19 pandemic has changed our lives in almost every aspect! We are trying utmost to brace ourselves from this deadly virus!

Eventually, our priorities have changed. We are bound to change our age-old habits too! Let me give you a common example!

Earlier, when we used to meet our friends, hugging each other was a common occurrence! But due to this pandemic, we need to maintain social distance!

That’s why the concept of handshake is replaced by “footshake” or elbow bumps since the pandemic has started!

However, this is just a small example of how COVID-19 has affected our lives! If you see the other aspects, especially the financial aspect, the COVID-19 has devastated it!

A recent Fortune report reveals that over 44.2 million people in our country have filed for unemployment benefits due to the coronavirus pandemic!

Besides, many people are losing jobs or getting a pay cut due to the loss of business during this pandemic!

At this moment, if you have outstanding debt and bills, you might be more worried about it. Because, the interest rates, late fees, or penalties don’t stop due to any pandemic!

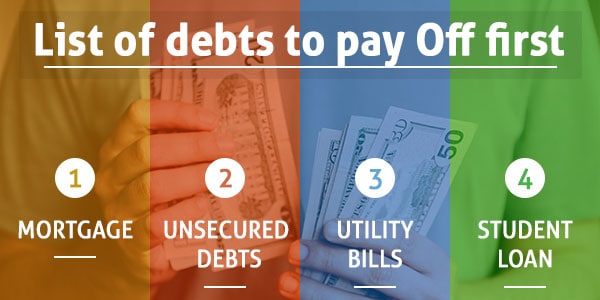

So, here we are gonna discuss which bills and debts to pay off first during the COVID-19 pandemic, which will be beneficial for your financial future!

Let’s start!

Your mortgage or rental payment

The shelter is one of the basic needs of human beings. So, your priority should be paying off your mortgage or rent firs

If you fail to make mortgage payments, it can lead to foreclosure of your home. And not paying your rents can lead to eviction from your rented property!

If you have taken out a federally-backed mortgage loan, then the CARES Act can be your savior! If you have lost your income due to the pandemic, you can request forbearance for 180 days and your lender can’t foreclose you till August 31, 2020. And no interest or late fees will be accrued during this period.

But problems can arise if you have taken out a private mortgage loan. Well, some of the private lenders are offering repayment assistance. So, you need to talk to your lender and check what accommodations are available!

If you fall behind your mortgage payments, you are likely gonna receive a notice within 15 days. After 30 days, your mortgage will be considered as a default and the lender will report it to the credit bureaus!

And once it’s due for 120 days or more, the lender will foreclose you. That means, your lender will take possession of your property and remove you! So, if you are financially impacted by the COVID-19, talk to your lender and look for repayment options, if any!

Secondly, if you are a renter and your landlord has taken out a federally-backed mortgage, as per the CARES Act, your landlord can’t serve you an eviction notice till July 25, 2020. The notice must be given to you in 30 days advance to leave the property.

During this moratorium period, your landlord might not charge you any late fees or penalties. But you will still owe the rent for this period to your landlord!

So, if you plan to shift to a different home or your landlord serves you an eviction notice, talk to your landlord and pay off your rent asap!

What if your landlord has taken out a private mortgage loan?

Then you should talk to your landlord about your financial hardship due to the pandemic. And look for state or county relief options for renters who are going through financial hardship due to COVID-19!

Pay off your unsecured debts

Unsecured loans have usually higher rates of interest as you don’t need to keep any collateral! Besides, if you fail to make payments on time, you will be charged a hefty late fee!

So, you need to prioritize your unsecured debts as most likely, you have to shell out a substantial amount of your paycheck to pay them off! If you pay off your unsecured debts, you can free up that amount of money. And you can utilize those funds to pay off your other debts and bills.

During this pandemic, many of us are slogging to pay off our debts, especially unsecured ones due to its high-interest rates!

The sad part is, the CARES Act has not provided any relief to the people who have unsecured debts to pay off!s

TOne of the popular and common unsecured debts is credit cards! A recent CreditCards.com poll reveals that about 59% of the credit cardholders in our country entered this pandemic with debt! So, if you are one of them, you should get rid of your credit card debt asap!

If you are going through financial hardship due to this pandemic, talk to your creditors now! Many credit card companies like Capital One, Chase, etc. are offering repayment assistance to their consumers.

Otherwise, you will have to shell out a lot of money due to high-interest rates along with late fees!

So, talk to your creditors and explain your financial situation! Hopefully, you will get some sort of repayment assistance from your creditors!

But don’t stop making payments on your credit cards suddenly! Because, if you fail to make payments, your outstanding balance will keep on increasing and you are likely gonna receive collection calls soon! And your creditors can sue you in court for nonpayment of your credit cards!

So, first, talk to your creditors about your financial hardship! If your creditors don’t offer you any repayment assistance, you can settle your credit cards and get rid of them!

Don’t postpone paying off your utility bills

Utilities like gas, electricity, water, and sewer are an integral part of our lives. So, you have to make sure that you are not failing to make payments for your utility bills.

Usually, an electricity bill is due 21 days after the meter reading is done! If you fail to pay by the due date, you will get an additional 5 business days to make a payment including a late fee!

After that, the nonpayment of utility bills means your connections are likely gonna get shut off!

However, if you are going through financial hardship due to COVID-19, talk to your service provider.

Many utility companies like Duke, PG & E, etc. are reaching out to their customers who are facing difficulties in paying their electricity and gas bills! They are temporarily halting disconnections and waiving off late fees too!

Therefore, for the time being, talk to your service provider and try to pay a portion if they allow you to do so.

Pay off your student loans

Have you taken out a federal student loan?

If yes, the CARES Act provides you an interim relief till September 30, 2020. That means, if you are going through financial hardship due to COVID-19, you can skip payments till September 30, 2020. And guess what? No interest will be accrued during this period.

However, if you are financially capable of paying off your student loans, continue making payments! But why am I telling you this?

Remember, your student loan debt amount (outstanding principal amount along with interest) is not gonna reduce! It will start accruing again after September 30, 2020.

So, this is the right time to reduce your outstanding principal amount as no interest will be accrued during this period! Eventually, your monthly payments for your student loan is likely gonna reduce after September 30, 2020.

So, try to make regular payments for your student loans now as much as possible to reap the benefits soon! And if possible, you can pay a bit more than your monthly payments to get rid of your student loans faster!

What if you have taken out a private student loan?

Well, in that case, you have to make the necessary payments along with interest.

Because falling behind on your student loan payments will result in delinquency status in your credit report. And your student loan can go into collections as well!

During this pandemic, some private student loan servicers like Earnest, SoFi, etc. are offering forbearance programs for the people who are going through financial hardship.

If you really can’t make the payments, you can opt for student loan forbearance. But remember, interest will be accrued during the period for which you are not making payments.

So, contact your student loan servicer asap, explain your financial situation, and know about the repayment assistance options they are providing. Till then, try not to stop making payments for your student loans!

So, the bottom line is, you have to take a balanced approach while deciding which bill and debt to pay off first during COVID-19! You need to chalk out a strategy that can help you manage your finances during this pandemic situation the best way!

Mortgages and student loans usually have much lower interest rates than unsecured loans like credit cards, payday loans, etc.

So, if your mortgage or student loan servicer is offering interim relief for COVID-19, you can focus on your unsecured debts now!

But what if you are not getting any repayment assistance from your mortgage or student loan servicer?

You can opt for a debt management plan (DMP) and get immediate help for your unsecured debts! The credit counselors of a genuine debt management company will try to negotiate with your creditors and propose an affordable repayment plan!

Doing so will help you to focus on your necessary payments like mortgage, rent, utilities, etc. And you will get rid of your high-interest unsecured debt with ease by opting for a DMP.

However, if you have a loss in income or have lost your job due to COVID-19, talk to your lenders asap and discuss your financial situation. Hopefully, you will get some sort of repayment assistance!

Lastly, don’t worry, the situation is gonna get better soon! Till then, stay safe and stay happy!